Maximus Assets Restricted (‘Maximus’ or the ‘Firm’, ASX:MXR) is happy to replace shareholders on assay outcomes acquired from a accomplished Reverse Circulation (RC) drill program on the Hilditch gold deposit (Hilditch) (90Å Maximus, 10Å Bullabulling Pty Ltd) positioned on a granted mining tenement 25km from Kambalda, Western Australia

- Assay outcomes from a Reverse Circulation (RC) drill program on the Hilditch gold deposit return a number of shallow high-grade intersections, together with:

- 19m @ 3.21g/t Au from 16m incl. 6m @ 5.64g/t Au from 18m and 5m @ 3.28g/t Au from 30m (HGRC065)

- 9m @ 3.11g/t Au from 63m incl. 4m @ 4.84g/t Au from 63m (HGRC068)

- 15m @ 1.12g/t Au from 24m incl. 1m @ 2.85g/t Au from 25m and 4m @ 2.12g/t Au from 35m (HGRC067)

- 5m @ 1.61g/t Au from 48m incl. 1m @ 2.02g/t Au from 48m and 1m @ 2.0g/t Au from 51m (HGRC065)

- Consultant minable ore-grade intervals have been submitted for metallurgical check work beneath real-world toll milling protocols with outcomes anticipated to be acquired in October. Preliminary outcomes as much as 95.8Å restoration of gold.

- Up to date Mineral Useful resource Estimate (MRE) for Hilditch gold deposit focused for October 2024.

- Improvement research together with geotechnical, environmental, infrastructure, floor water and hydrogeology assessments vital for the mine approval course of are advancing.

- The Hilditch gold challenge is located on granted mining tenements, with glorious entry to infrastructure, service suppliers and a number of other toll-treating choices inside a 60km haulage.

- The Firm is in lively discussions with potential mining and toll-milling companions.

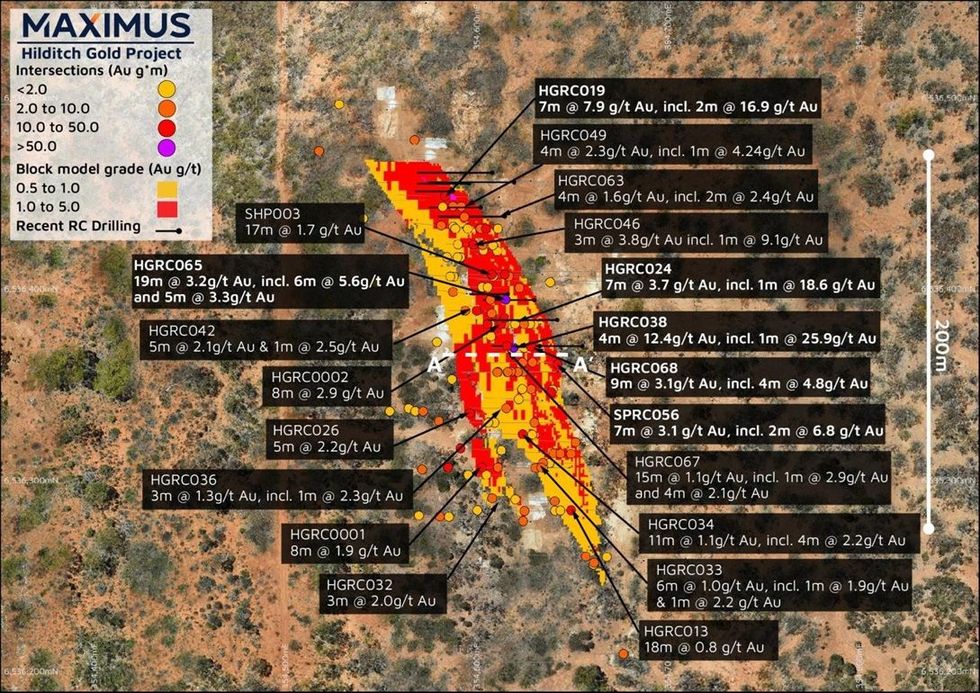

Eleven RC holes (722m) had been drilled at Hilditch to research latest intersected high-grade zones. The Firm has commenced updating the Hilditch Mineral Useful resource Estimate (MRE) to finalise optimised open-pit designs, aiming to safe mine approvals and advance discussions with potential mining and toll milling companions.

Maximus’ Managing Director, Tim Wither, commented, “The latest drilling outcomes, together with 19m @ 3.21g/t Au from 16m, fall inside optimised open pit shells and help the MRE replace previous to finishing open pit designs. Hilditch gives a promising near-term gold manufacturing prospect for Maximus, located on an authorized mining tenement close to the Coolgardie-Norseman freeway, and inside shut proximity to a number of regional gold processing services.

“These new drilling outcomes efficiently develop the high-grade mineralised zones, and considerably enhance the financial outlook for Hilditch, with efforts focused on advancing open pit improvement to generate money move for the Firm, capitalising on the rising gold worth surroundings.”

Hilditch Gold Deposit

Hilditch is positioned on a granted mining tenement adjoining to the Coolgardie-Norseman freeway and is proximal to a number of toll-treating processing crops. The present 19,500 oz Au @ 1.3 g/t Au mineral useful resource is shallow, with mineralisation commencing on the floor over a 200m strike size and stays open at depth with important strike extension to be examined (ASX announcement 19 December 2023). The finished RC drill program was geared toward infill and useful resource extension to improve materials classification into the indicated class, earlier than updating the Hilditch MRE.

Gold mineralisation at Hilditch is interpreted to be related to east-dipping structurally managed contacts between mafic/ultramafic and volcaniclastic models. Minor interflow sediments are noticed throughout the mafic and ultramafic sequence, much like that prevalent on the Firm’s Wattle Dam Gold Mission. Within the Hilditch area, the rocks present in depth weathering, reaching a median depth of 20 metres under the floor, indicative of full oxidation. From 20 to 40 metres, there exists a transitional zone, and past 40 metres, the rock is unweathered and comprises main mineralisation.

Preliminary metallurgical check work indicative of the Hilditch open-pit gold useful resource is free milling (non-refractory) with distinctive gold recoveries between 91.4Å and 95.8Å, indicating that the mineable ore may be very amenable to traditional Carbon in Leach (CIL) gold processing discovered all through Western Australia’s Japanese Goldfields. Accomplished metallurgical checks coated varied gold grades and oxidation phases, making certain consultant sampling throughout anticipated mining depths (ASX announcement 3 July 2024). Additional checks are underway to characterize real- world toll milling protocols (Determine 2).

Drilling Outcomes

The newest spherical of drilling expanded upon earlier high-grade intersections close to gap HGRC038, which had reported 4m @ 12.44g/t Au from 47m, together with 1m @ 25.93g/t Au from 47m (Determine 1) (ASX announcement 15 August 2024).

5 RC holes had been drilled in proximity to HGRC038. Notably, gap HGRC065, positioned 25m north of HGRC038, intersected 19m @ 3.21g/t Au from 16m, together with 6m @ 5.64g/t Au from 18m and 5m @ 3.28g/t Au from 30m, successfully extending the high-grade zone to the north.

Moreover, gap HGRC068, located 15m down-dip of HGRC038, intercepted 9m @ 3.11g/t Au from 63m, together with 4m @ 4.84g/t Au from 63m. HGRC067 drilled 15m up-dip of HGRC038 returned 15m @ 1.12g/t Au from 24m, with notable intervals of 1m @ 2.85g/t Au from 25m and 4m @ 2.12g/t Au from 35m (Determine 3). These outcomes affirm a well-defined, high-grade gold zone throughout the central a part of the deposit, bolstering geological confidence and continuity of high-grade mineralisation.

On the northern restrict of the deposit, a number of drill holes had been positioned to the north of beforehand reported gap HGRC019, which intersected 7m @ 7.9 g/t Au from 51m, together with 2m @ 16.9 g/t Au from 52m (ASX announcement 14 June 2022), in an effort to increase the useful resource alongside strike. Nonetheless, drill holes HGRC059 to HGRC061 did not return important outcomes, confirming that the mineralisation is closed off alongside strike to the north.

Click on right here for the total ASX Launch

This text contains content material from Maximus Assets Restricted, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your accountability to carry out correct due diligence earlier than performing upon any data supplied right here. Please check with our full disclaimer right here.