The Royal Swedish Academy of Sciences acknowledged developments in synthetic intelligence (AI) this week, handing out two prizes to researchers working within the subject.

In the meantime, Bitcoin’s value actions confirmed that the cryptocurrency continues to be closely influenced by macroeconomic components, and Tesla (NASDAQ:TSLA) lastly gave traders a glimpse of its long-awaited full autonomous automobile, leaving them unimpressed.

At OpenAI, monetary projections reveal that income are nonetheless a methods away.

Keep knowledgeable on the most recent developments within the tech world with the Investing Information Community’s round-up.

1. AI takes dwelling two Nobel Prizes

The Royal Swedish Academy of Sciences introduced the annual Nobel prizes this week, bestowing two of the three prizes in science to researchers in synthetic intelligence (AI).

On Tuesday, the Nobel Prize in physics was given to Canadian laptop scientist Geoffrey Hinton and American physicist John Hopfield. Their analysis into neural networks laid the inspiration to develop machine studying know-how based mostly on the best way the human mind processes data.

Hopfield’s invention, a pc that works like a human mind, can retailer patterns and recall them even when given solely partial data. Hinton’s analysis led him to create a approach to assist computer systems to find patterns on their very own, basically permitting them to “be taught” with out being programmed.

On Wednesday, Sir Demis Hassabis, the CEO of Google DeepMind and Isomorphic Labs, and John Jumper, Director of Google DeepMind, have been awarded the Noble Prize in chemistry for the event of AlphaFold 2, an AI mannequin developed by the Alphabet (NASDAQ:GOOGL) subsidiary in 2020 to foretell the three-dimensional construction of a protein.

A protein’s perform is set by its construction, which is an exceptionally tough — and costly — process for human researchers. In July 2021, AlphaFold 2 precisely predicted the construction of nearly all 200 million recognized proteins, utilizing solely their amino acid sequences as enter. This revolutionary know-how has led to groundbreaking discoveries in science and drugs and has the potential to speed up drug discovery and growth.

It wasn’t all excellent news for Alphabet firms this week. On Monday, the choose ordered Google to overtake its cellular app retailer, permitting Android customers to buy apps from different suppliers. Subsequently, on Wednesday, the US Division of Justice indicated it could search a court docket order to drive Google to separate its Chrome and Android companies, following the ruling in its antitrust case towards the tech big on August 5. Shares of Google inventory are down 2.65 % for the week.

2. Tesla Cybercab unveiling falls flat

Tesla shares fell 8.78 % on Friday afternoon after the electrical automobile maker unveiled its long-awaited totally autonomous mannequin on Thursday night. The Cybercab, a two-seater with no steering wheel or foot pedals, was introduced an hour late on the firm’s “We Robotic” occasion on the Warner Brothers studio in Burbank.

Throughout the presentation, Tesla’s CEO Elon Musk instructed the viewers that the mannequin would price under US$30,000 and that the corporate “hoped” to start manufacturing earlier than 2027, however didn’t provide particular particulars as to the place, how or when manufacturing would start. Musk additionally revealed his firm’s plans to supply a completely autonomous 20-passenger Robovan however gave no additional particulars apart from that each autos would cost wirelessly.

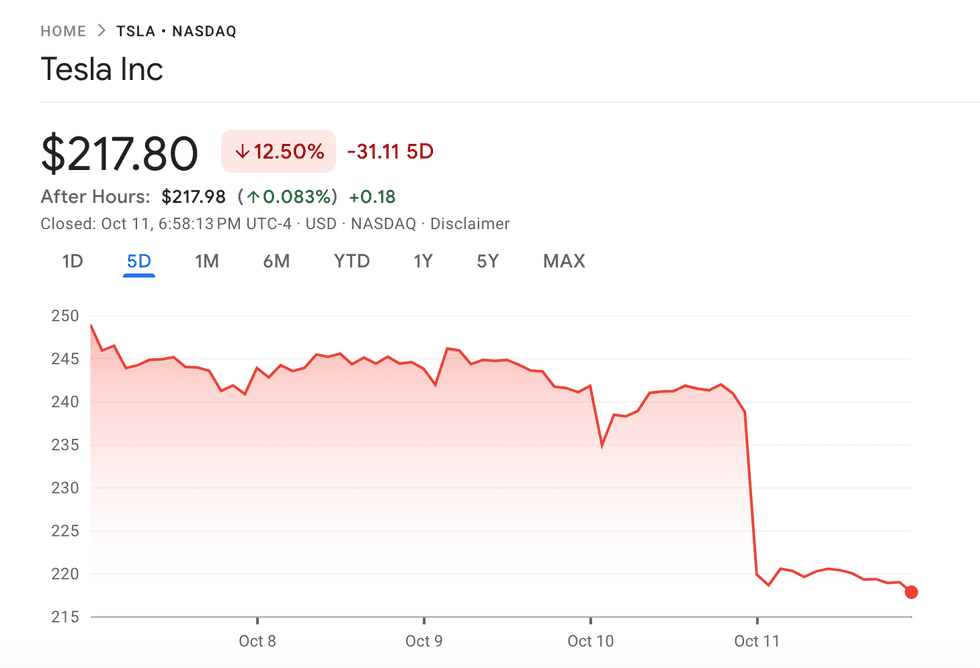

Tesla’s value actions for the week ending October 11.

Chart by way of Google Finance.

Musk additionally supplied an replace on the event of Tesla’s full-self driving (FSD) know-how, which is ready to roll out in China in 2025 however has confronted regulatory hurdles within the US. Musk stated he expects to put in FSD in Mannequin 3 and Mannequin Y Teslas in Texas and California “subsequent yr,” however was unable to offer a set launch date.

As of writing, Tesla is down 12.5 % for the week and 12.33 % year-to-date.

3. Samsung apologizes for disappointing quarterly projections

South Korean tech firm Samsung (KRX:005930) posted its Q3 revenue steerage on Tuesday, asserting that it expects working income to surge by 274 % for the quarter to round 9.1 trillion Korean gained, roughly US$6.74 billion. Whereas this determine signifies spectacular development from the two.43 trillion gained in income the corporate earned throughout Q3 2023, it missed LSEG expectations of 11.45 trillion gained, leading to a 1.47 % lower in share worth on Tuesday morning.

Samsung’s vice chairman, Jun Younger-hyun, issued an apology following the report’s launch, translated right here by CNBC. He citing the decline to “one-time prices and destructive impacts” within the firm’s reminiscence division, together with “stock changes by cellular prospects and elevated provide of legacy merchandise by Chinese language reminiscence firms.”

He went on to vow shareholders that Samsung’s leaders “will put together for the long run extra completely.”

In a translated assertion, Younger-hyun stated, “Samsung … has all the time turned crises into alternatives, having a historical past of problem, innovation, and overcoming. We will certainly make the dire scenario we’re presently going through a chance for a leap ahead.” Shares of Samsung are down 3.26 % for the week.

4. Income nonetheless years away for OpenAI

The Data reported on Wednesday that, regardless of OpenAI’s speedy development, the corporate initiatives it should lose as much as US$14 billion in 2026, with losses totaling US$44 billion between 2023 and 2028. In response to paperwork the Data says it has seen first-hand, OpenAI plans to spend as much as US$200 billion coaching new AI fashions by the tip of the last decade.

Underneath the phrases of OpenAI’s most up-to-date funding spherical, which raised US$6.6 billion and included contributions from enterprise capitalist agency Andreesseen-Horowitz, Microsoft (NASDAQ:MSFT) and Nvidia (NASDAQ:NVDA), OpenAI was required to restructure its enterprise mannequin, handing management over to a for-profit arm. Nevertheless, based mostly on these projections, the corporate, which is now valued at US$157 billion, doesn’t count on to change into worthwhile till 2029. At the moment, in response to the Data, it hopes to realize US$100 billion in income primarily pushed by ChatGPT.

5. Bitcoin wobbles midweek, however recovers

In the beginning of the week, Bitcoin’s value fluctuated round US$63,000, influenced closely by China’s failure to offer an in depth stimulus plan, whereas meme cash rallied. On Monday, Ether ETFs skilled zero flows in or out for the second time since their inception, whereas Bitcoin ETFs noticed their highest inflows since September 27 that day.

Bitcoin’s value decreased by Wednesday forward of Thursday’s client value index (CPI) knowledge launch, and plunged within the hour following the discharge. This despatched it under US$60,000 for the primary time in October, a traditionally bullish month.

The info confirmed that the CPI rose 0.2 % from final month and simply 2.4 % year-over-year, its smallest annual rise since inflation first started surging in February 2021.

Bitcoin started trending upwards after the drop, and briefly moved again above US$63,000 Friday afternoon.

Remember to comply with us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.