October 18, 2024 (Investorideas.com Newswire) Further drilling on the Adit Zone continues to intersect broad higher-grade mineralization close to floor and prolong the copper-gold-silver (+/- molybdenum) porphyry system at Kodiak Copper’s (TSX.V:KDK, OTCQB:KDKCF, Frankfurt:5DD1) MPD mission situated close to Princeton, BC.

The Vancouver-based firm on Tuesday reported drill outcomes from the 2024 drill program at its 100%-owned MPD copper-gold porphyry mission in southern British Columbia. Assay outcomes from 4 drill holes on the Adit Zone and the Celeste goal had been introduced.

“A key focus of Kodiak’s 2024 drill program was to determine extra near-surface and high-grade mineralization, and drill outcomes from the Adit Zone to this point have clearly achieved this,” mentioned Claudia Tornquist, Kodiak’s president and CEO, within the Oct. 15 information launch. She added:

“The holes reported on this information launch considerably prolong the copper envelope at Adit and when mixed with historic drilling, Kodiak’s new outcomes have outlined a sizeable near-surface, high-grade space of mineralization which bodes effectively for future financial potential. Along with the Gate and West Zones, Adit is growing into a 3rd substantial high-grade zone at MPD, marking an essential development for the mission. Adit stays open in a number of instructions, and we’re wanting ahead to additional drill outcomes from this zone in addition to from different targets over the rest of 2024 and into 2025.”

Adit Zone Drilling

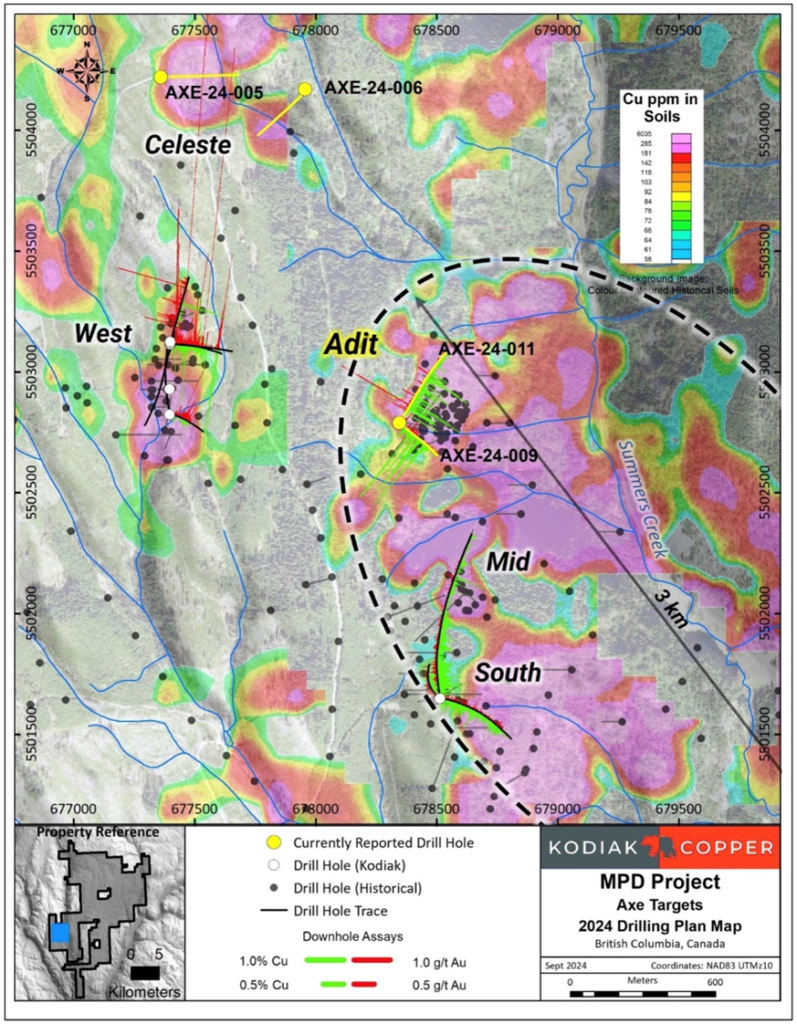

The corporate’s holes reported to this point on the Adit Zone focused broad, coincident 3D IP chargeability and copper-in-soil anomalies. The anomalies are situated on the northern finish of a geophysical-geochemical pattern west of the Summers Creek fault that hyperlinks the Adit, Mid and South zones, and suggests these mineralized zones are half of a bigger copper system (Determine 2).

Shallow historic drilling on the Adit Zone recognized mineralization over 300 meters of strike inside a broader alteration zone characterised by supergene leaching and shallow (<200-meter) copper oxides. Kodiak’s present drilling has intersected vital copper sulfide mineralization past the oxide zone and fault buildings beforehand thought to restrict mineralization.

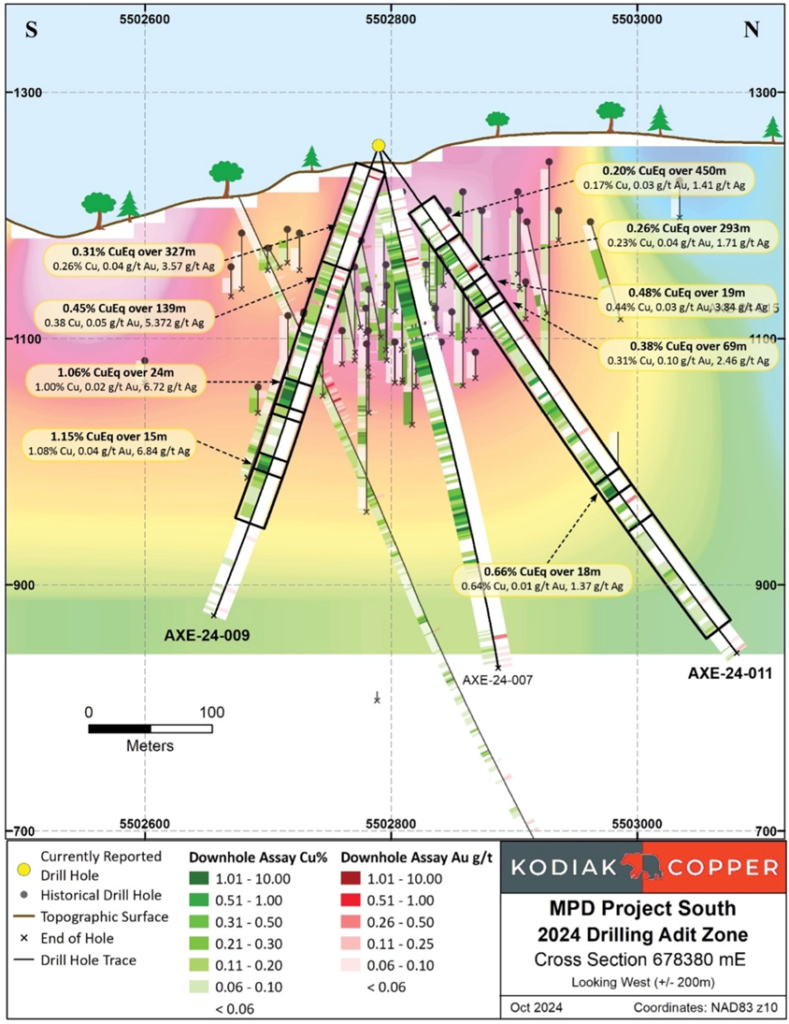

Drill holes AXE-24-009 and AXE-24-011 had been drilled from the identical set-up as AXE-24-007, however to the southeast and northeast, respectively. The holes had been designed to increase the strike of mineralization at Adit, check beneath historic percussion holes that not often exceeded 100 meters depth, and goal copper-in-soil / 3D IP anomalies. (Determine 3). Just like AXE-24-007, holes AXE-24-009 and 011 have broad intervals (>300m) of Cu-Ag-Au (+/-Mo, Zn, Pb) mineralization, with zones of upper grades famous in each oxide and sulfide faces.

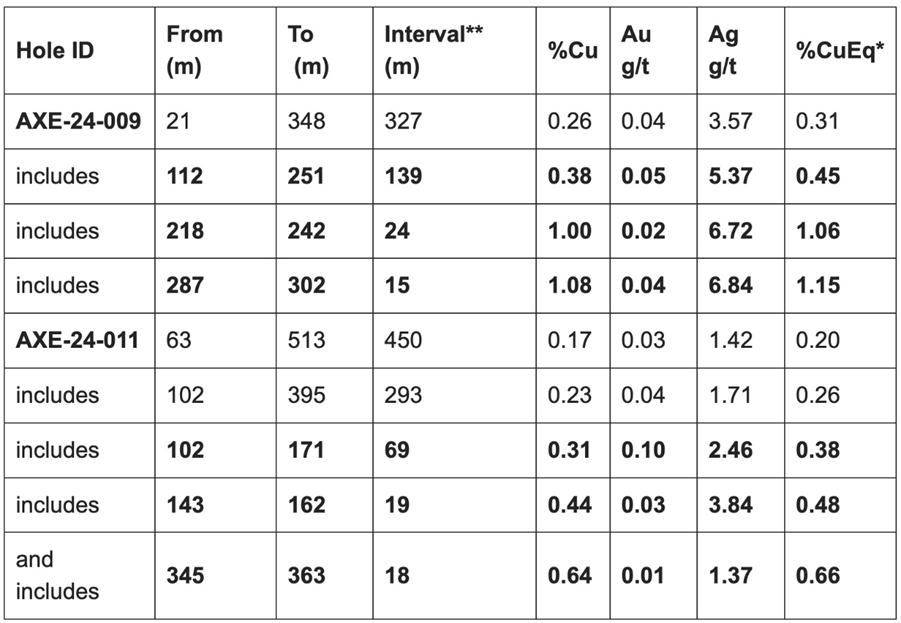

Highlights included:

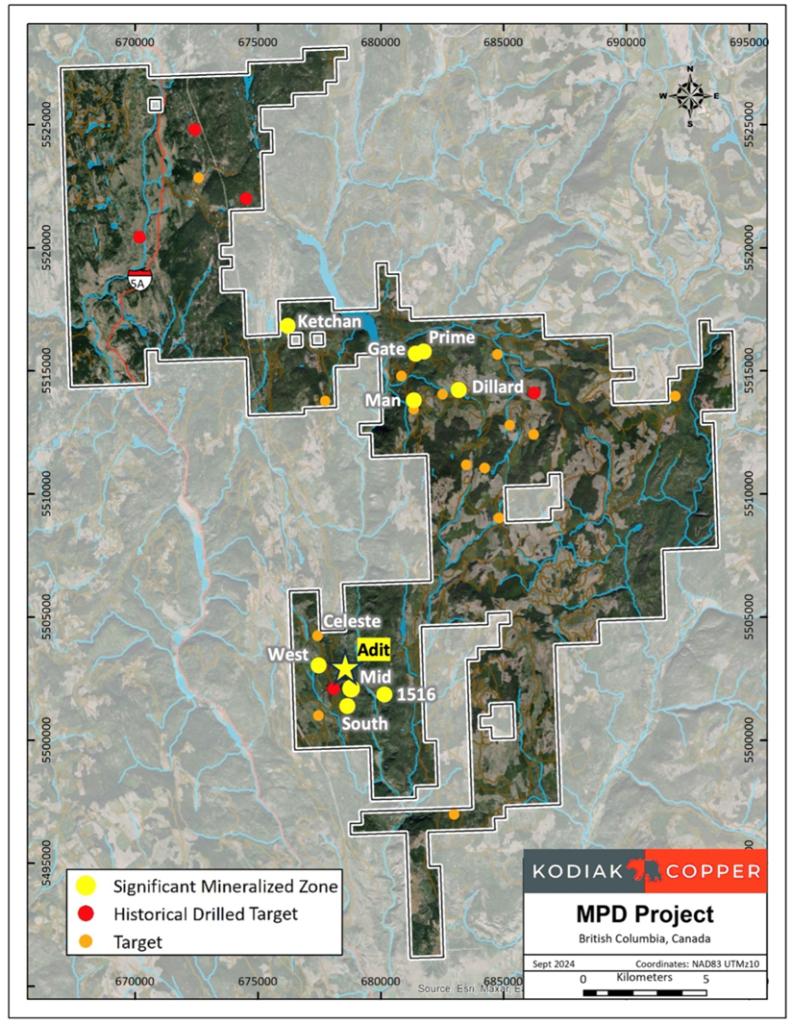

- Further drilling on the Adit Zone continues to intersect broad higher-grade mineralization close to floor and prolong the copper-gold-silver (+/- molybdenum) porphyry system (Figures 1 and a couple of).

- Drill holes AXE-24-009 and 011 prolonged mineralization an extra 200 meters beneath shallow historic drilling within the north and south, and to over 400 meters of strike size. The Adit Zone stays open in a number of instructions (Figures 2 and three).

- All mineralization drilled by Kodiak at Adit to this point is inside 350 meters of floor as a result of slope of the topography within the space (Determine 3).

- Drill gap AXE-24-009 intersected a broad interval of 0.26% Cu, 0.04 g/t Au, 3.57 g/t Ag (0.31% CuEq) over 327 meters from 21 to 348 meters, together with 0.38% Cu, 0.05 g/t Au, 5.37 g/t Ag (0.45% CuEq) over 139 meters from 112 to 251 meters (Figures 2 to 4).

- AXE-24-009 additionally incorporates a number of higher-grade intervals: 1.00% Cu, 0.02 g/t Au, 6.72 g/t Ag (1.06% CuEq) over 24 meters from 218 to 242 meters and 1.08% Cu, 0.04 g/t Au, 6.84 g/t Ag, (1.15% CuEq) over 15 meters from 287 to 302 meters.

- Drill gap AXE-24-011 intersected 0.17% Cu, 0.03 g/t Au, 1.42 g/t Ag (0.20% CuEq) over 450 meters from 63 to 513 metres, together with 0.23% Cu, 0.04 g/t Au, 1.71 g/t Ag (0.26% CuEq) over 293 meters from 102 to 395 meters (Figures 2 to 4).

- Equally, AXE-24-011 additionally incorporates higher-grade intervals: 0.44% Cu, 0.03 g/t Au, 3.84 g/t Ag (0.48% CuEq) over 19 meters from 143 to 162 meters and 0.64% Cu, 0.01 g/t Au, 1.37 g/t Ag, (0.66% CuEq) over 18 meters from 345 to 363 meters.

- Drilling on the Adit Zone focused coincident copper-in-soil and 3D induced polarization (3D IP) chargeability anomalies that counsel it’s half of a bigger porphyry system (Determine 2). The present drilling is designed to increase Adit to depth and alongside strike. Further drill holes have been accomplished with assays pending.

Determine 1:2024 Vital mineralized zones and goal location map – MPD Undertaking, southern BC

Determine 2: Plan map exhibiting vital mineralized zones with historic and Kodiak drilling to this point. New 2024 holes at Adit and Celeste reported herein are yellow traces with assays. Bar graphs present downhole copper (inexperienced) and gold (pink) values for the Kodiak drilling. Background is colour-contoured copper-in soil information.

Determine 3: Adit Zone north-south lengthy part at 678380mE (wanting west into steep slope). Background is colour-contoured 3D IP Chargeability (SJV Geophysics, 2005). Outcomes from gap AXE-24-009 and AXE-24-011 are in Desk 1.

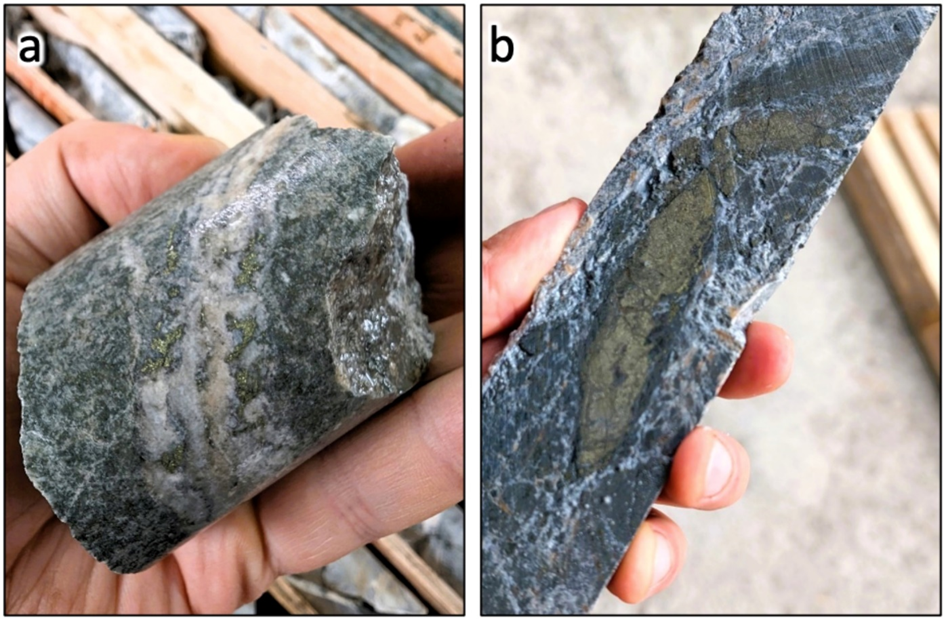

Determine 4: Examples of core from 2024 drilling on the Adit Zone: a) Axe-24-009: Diorite with chalcopyrite-pyrite in quartz-carbonate veining changing feldspar, in 24m high-grade interval assaying 1.00% Cu, 0.02 g/t Au and 6.72 g/t Ag from 218 to 242; b) Axe-24-011: Bands of large pyrite-chalcopyrite in robust quartz-sericite-pyrite altered part of monzodiorite at 301m, inside broad 29 m interval assaying 0.23% Cu, 0.04 g/t Au and 1.71 g/t Ag from 102 to 395m.

Celeste Zone Drilling

The Celeste Goal lies 600 meters north of the high-grade West Zone. Drilling evaluated a 700-meter-long copper-in-soil anomaly,anomalous prospecting samples from 2023, and a historic 3D-IP response.

Gap AXE-24-005 was drilled eastward throughout the copper-in-soil anomaly and encountered largely volcanoclastic rocks with shallow however brief intervals of skarn-type alteration. The opening resulted in a strongly altered fault with hint mineralization from 234 meters to finish of gap at 477 meters. Assays from gap AXE-24-005 weren’t vital. Gap AXE-24-006 was drilled southwest testing a excessive chargeability goal from a second pad 600 meters east of AXE-24-005. This gap encountered largely altered granodiorite with patchy pyrite and hint chalcopyrite however doesn’t warrant assaying presently.

Desk 1: Weighted assay intervals for 2024 drill holes AXE-24-009 and AXE-24-011 (Adit Zone). See Figures 2 to 4.

* Copper equal grades (%CuEq) are for comparative functions solely to specific the mixed abundance of copper, gold, and silver. Metallurgical work has not been carried out on the MPD Undertaking and steel recoveries utilized in equivalency calculations are from comparable deposits and/or mines. Metallurgical restoration is assumed as 88% for copper, 67% for gold and 68% for silver. Metallic costs utilized in calculations are: US$4.10/lb copper, US$2,200/oz gold, and US$26/oz silver, utilizing the components: CuEq % =Cu % + Au g/t x 0.5959 + Ag g/t x 0.0071

**Intervals are downhole drilled core intervals. Drilling information to this point is inadequate to find out true width of mineralization.

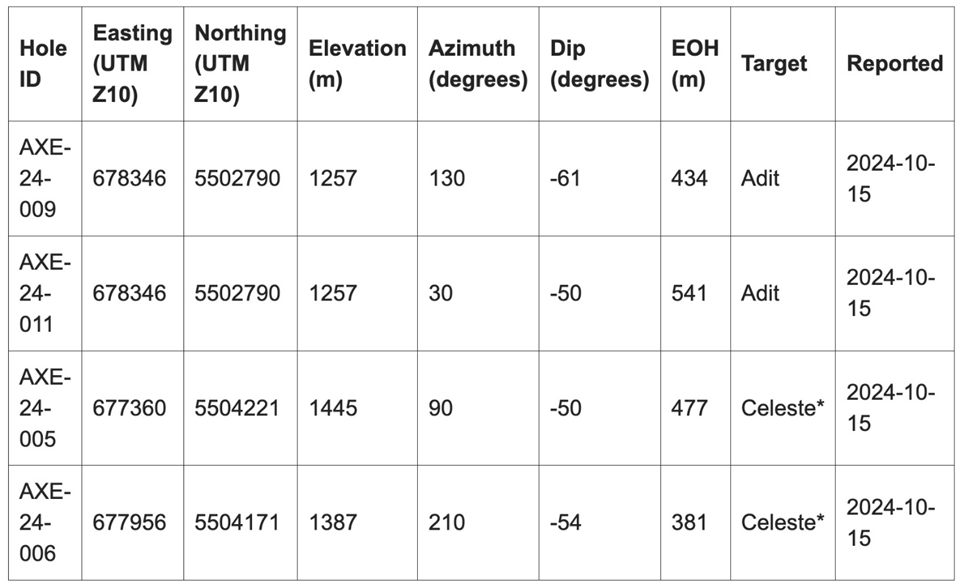

Desk 2:2024 MPD drill collar info

* Drill gap had no vital assays or didn’t warrant assaying presently.

The drilling portion of 2024 exploration at MPD is now full, with 9,252 meters drilled in 25 holes which evaluated seven targets and/or zones. Outcomes from the rest of drilling in 2024 might be reported all through This fall 2024 and Q1 2025. Regional exploration on the mission remains to be ongoing and features a 2,000-sample soil geochemistry program, 25 line-kilometers of 3D IP surveying, and a assessment of core from the newly acquired Aspen Grove claims.

MPD is a 338-square-kilometer land package deal close to a number of working mines within the southern Quesnel Terrane, British Columbia’s major copper-gold producing belt. The mission is between the cities of Merritt and Princeton, with year-round accessibility and glorious infrastructure close by.

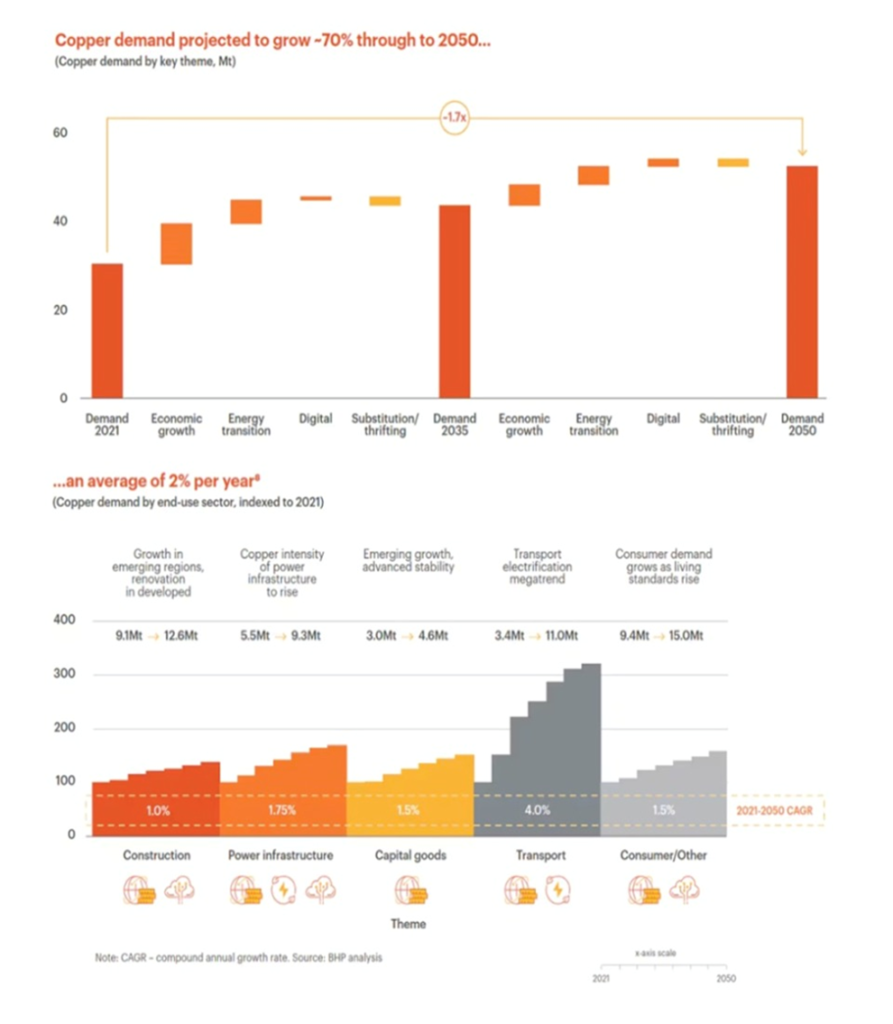

Copper market

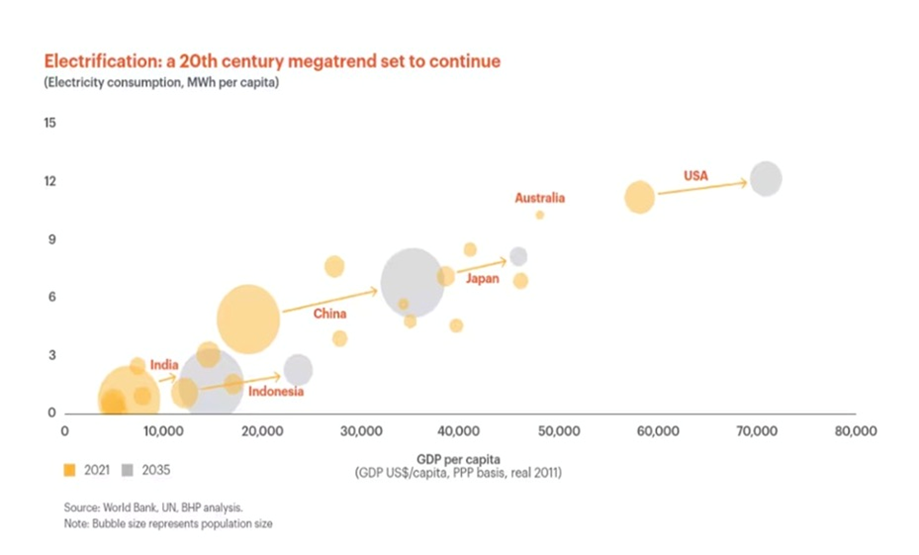

“As we glance in the direction of 2050, we foresee international copper demand growing by 70% to succeed in 50 million tonnes yearly. This might be pushed by copper’s function in each present and rising applied sciences, in addition to the world’s decarbonization targets,” says BHP’s chief industrial officer Rag Udd.

The most important mining firm on this planet expects that by 2050 the power transition sector will characterize 23% of copper demand in comparison with the present 7%. The digital sector together with information facilities, 5G and AI is projected to rise from 1% right this moment to six%.

Transportation’s share of copper demand is anticipated to climb from about 11% in 2021 to twenty% by 2040, because of the EV rollout.

On the availability aspect, BHP factors to the typical copper mine grade lowering by round 40% since 1991. The subsequent decade ought to see between one-third and one-half of the worldwide copper provide dealing with grade decline and growing older challenges.

The corporate estimates that an funding of $250 billion might be required to deal with the widening hole between provide and demand.

Two different sources affirm that vast new investments within the copper sector are required.

In accordance with BloombergNEF’s annual Transition Metals Outlook, the business will want $2.1 trillion by 2050 to satisfy the uncooked supplies demand of a net-zero-transmissions world. As acknowledged by Mining.com,

Regardless of a decade of progress in metals provide, BNEF stories that present uncooked materials availability stays inadequate to satisfy the rising demand.

The report highlights that important power transition metals, together with aluminum, copper, and lithium, may face provide deficits this decade -some as early as this yr.

China is the world’s largest copper client, so what occurs there may be watched carefully be copper bulls and bears alike.

Copper bulls vs bears – Richard Mills

This week, information from China’s Normal Administration of Customs confirmed imports of unwrought copper rose in September on account of enhancing seasonal demand a greater consumption outlook.

Imports of unwrought copper and merchandise had been 479,000 tonnes final month, a 15.4% soar in comparison with August.

China in September introduced its largest financial stimulus for the reason that pandemic, which prompted huge jumps in Chinese language and American inventory markets, together with commodities.

The goal is to realize its 5% annual progress goal.

Yahoo Finance reported the stimulus – designed to drag the economic system out of a hunch prompted be a property disaster and deflationary measures – contains over $325 billion in financial measures.

The Folks’s Financial institution of China lowered the reserve requirement ratio – the quantity required by banks to put aside for loans – by half a proportion level, releasing up about $142 billion in short-term liquidity.

The plan additionally lowers short- to medium-term rates of interest and makes mortgage aid a prime precedence, says Yahoo Finance.

These strikes are anticipated to profit about 50 million households, saving them $21.3B yearly in curiosity bills.

The central financial institution additionally launched a plan to prop up China’s ailing inventory market. A $71 billion inventory market stabilization program will permit securities companies funds, and insurers to entry funding for inventory purchases by way of a swap facility, Yahoo Finance defined.

If China provides fiscal measures (i.e. authorities spending) to its financial instruments, significantly for infrastructure, Commodities would seemingly see one other huge push, impacting every part from US manufacturing to power sectors.

Fastmarkets initiatives copper costs will attain 10,265 per tonne ($4.65/lb), with the commercial steel experiencing upward strain in This fall, and bullish for the subsequent 12 months.

Supply: Kitco

Causes to spend money on KDK

Kodiak Copper’s MPD mission is situated alongside the southern-most portion of the Quesnel Trough, an especially potential for discovery mineral belt extending over 1,000 kilometers from Washington State to the Yukon border. It’s the longest mineral belt in Canada and British Columbia’s fundamental copper-producing belt.

Copper-gold porphyries embrace Copper Mountain, New Afton, Mount Milligan, Woodjam, Kwanika and Kemess. Teck’s Highland Valley is the largest open-pit mine in Canada.

The probabilities of efficiently discovering a deposit and constructing a mine are considerably greater when a expert group is in cost. Kodiak’s administration group, and the Discovery Group, have a profitable, an envious, observe file of shareholder returns.

Copper market fundamentals are at present robust, with analysts predicting growing demand dealing with the headwinds of structural provide deficits.

Most junior useful resource corporations are struggling to draw funding regardless of a constructive long-term outlook for mined commodities. KDK has accomplished its drill program for 2024, and traders can anticipate information effectively into 2025.

Kodiak Copper, by way of a singular mixture of superior fashionable know-how (AI) and quaint “boots on the bottom” exploration and prospecting gives vital publicity to copper and gold.

Exploration has already proven loads of dimension potential as KDK has now drilled a number of kilometer-scale zones of mineralization over nearly your complete size of the 20-km property.

A key focus of Kodiak’s 2024 drill program was to determine extra near-surface and high-grade mineralization. Drill outcomes from the Adit Zone to this point have clearly achieved this.

The holes considerably prolong the copper envelope at Adit and when mixed with historic drilling, Kodiak’s new outcomes have outlined a sizeable near-surface, high-grade space of mineralization.

The mission shares geological similarities to Copper Mountain and New Gold. All three are alkalic copper porphyries, that means the mineralization is copper-gold.

Junior useful resource firm valuations are low and Kodiak Copper’s MPD mission has all of the hallmarks of a serious copper/gold porphyry system with the potential to change into a world -class mine.

Kodiak’s MPD mission is in a low-cost, low-risk space. Infrastructure contains provides, roads, railway, extremely expert native workforce and low cost hydro energy.

With a powerful capital construction, money in hand, a completely funded exploration/ drilling program accomplished, and Teck Sources as their largest shareholder (holding 9.1%), it appears Kodiak Copper is well-positioned for progress.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free e-newsletter

Authorized Discover / Disclaimer

Forward of the Herd e-newsletter, aheadoftheherd.com, hereafter generally known as AOTH.

Please learn your complete Disclaimer fastidiously earlier than you employ this web site or learn the e-newsletter. If you don’t conform to all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/e-newsletter/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/e-newsletter/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc just isn’t, and shouldn’t be, construed as a suggestion to promote or the solicitation of a suggestion to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on info obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no accountability or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any info offered inside this Report and won’t be held responsible for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you’ll incur because of the use and existence of the knowledge offered inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills responsible for any direct or oblique buying and selling losses brought on by any info contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles just isn’t a suggestion to promote or a solicitation of a suggestion to purchase any safety. AOTH/Richard Mills just isn’t suggesting the transacting of any monetary devices.

Our publications will not be a suggestion to purchase or promote a safety – no info posted on this website is to be thought of funding recommendation or a suggestion to do something involving finance or cash apart from performing your individual due diligence and consulting along with your private registered dealer/monetary advisor. AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with knowledgeable monetary planner or advisor, and that it’s best to conduct a whole and unbiased investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd just isn’t a registered dealer, seller, analyst, or advisor. We maintain no funding licenses and should not promote, provide to promote, or provide to purchase any safety.

Extra Information:

Disclaimer/Disclosure: Investorideas.com is a digital writer of third occasion sourced information, articles and fairness analysis in addition to creates authentic content material, together with video, interviews and articles. Authentic content material created by investorideas is protected by copyright legal guidelines apart from syndication rights. Our website doesn’t make suggestions for purchases or sale of shares, companies or merchandise. Nothing on our websites ought to be construed as a suggestion or solicitation to purchase or promote merchandise or securities. All investing entails danger and potential losses. This website is at present compensated for information publication and distribution, social media and advertising, content material creation and extra. Disclosure is posted for every compensated information launch, content material revealed /created if required however in any other case the information was not compensated for and was revealed for the only curiosity of our readers and followers. Contact administration and IR of every firm straight concerning particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Study extra about publishing your information launch and our different information companies on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World traders should adhere to laws of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp