2024 third-quarter highlights:

- Manufacturing of 564,106 gold equal ounces (Au eq. oz.).

- Manufacturing value of gross sales of $976 per Au eq. oz. bought and attributable manufacturing value of gross sales 2 of $980 per Au eq. oz. bought.

- Attributable all-in sustaining value 2 of $1,350 per Au eq. oz. bought.

- Working money movement of $733.5 million.

- Attributable free money movement 2 document of $414.6 million and year-to-date attributable free money movement 2 of $905.8 million.

- Margins 3 elevated to $1,501 per Au eq. oz. bought, outpacing the rise within the common realized gold worth.

- Reported web earnings of $355.3 million, or $0.29 per share, with adjusted web earnings 2 of $298.7 million, or $0.24 per share 2 .

- Stability sheet energy : Kinross continued to strengthen its steadiness sheet, repaying $350.0 million on its time period mortgage in Q3 2024 and an extra $100.0 million on November 1, 2024.

- Kinross’ Board of Administrators declared a quarterly dividend of $0.03 per frequent share payable on December 12, 2024, to shareholders of document on the shut of enterprise on November 28, 2024.

- Steerage reaffirmed 4 : Kinross stays on monitor to fulfill its 2024 annual steerage for manufacturing, value of gross sales, all-in sustaining value and capital expenditures.

Operations:

- Tasiast had one other wonderful quarter with larger mill throughput charges and was once more the bottom value asset within the portfolio.

- Fort Knox delivered document grade and restoration as manufacturing commenced from Manh Choh through the quarter, leading to a big enhance in money movement from Fort Knox.

- Paracatu elevated manufacturing in contrast with Q2 2024 because of larger grades, in accordance with deliberate mine sequencing, and powerful recoveries.

- At Spherical Mountain Part S , the heap leach pad growth is now full, on schedule and beneath finances, with resolution utility permits acquired.

Growth initiatives and exploration:

- At Nice Bear , the Firm launched the Preliminary Financial Evaluation (PEA) on September 10, 2024. The Challenge is predicted to supply over 500,000 ounces per 12 months at spectacular margins with an all-in sustaining value of roughly $800 per ounce through the first 8 years. For the Superior Exploration (AEX) program, Kinross has submitted its last Closure Plan to the Ontario Ministry of Mines for its approval and is anticipating to start out early works building within the close to time period.

- At Spherical Mountain Part X and Curlew , exploration drilling is progressing nicely, with outcomes to this point displaying robust grades and widths.

CEO commentary:

J. Paul Rollinson, CEO, made the next feedback in relation to 2024 third-quarter outcomes:

“I’m happy to report that our portfolio of mines continued its wonderful efficiency, and we’re on monitor to fulfill our annual steerage.

“We stay closely centered on constant operational efficiency, value management, capital self-discipline and delivering on deliberate grades to generate worth for our shareholders. Our potential to carry prices on this robust gold worth setting continues to profit our margins, which grew by 14% to $1,501 per ounce bought in contrast with Q2 and the 6% enhance within the realized gold worth. We additionally delivered document free money movement, which elevated by 20% in contrast with the earlier quarter.

“In the course of the quarter, we launched the PEA at Nice Bear, which reaffirms our view of a high-quality, high-margin asset with sturdy economics, modest capital necessities and clear alternative for useful resource progress. Following an invite from the Ontario Ministry of Mines, we’re happy to have submitted our last AEX Closure Plan for approval, which is a crucial allowing milestone. We additionally accomplished the commissioning of our Manh Choh challenge leading to a big enhance in money movement from Fort Knox and superior Part X at Spherical Mountain.”

Abstract of economic and working outcomes

| Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | ||||||||||||

| (unaudited, in thousands and thousands of U.S. {dollars}, besides ounces, per share quantities, and per ounce quantities) | 2024 | 2023 | 2024 | 2023 | |||||||||

| Working Highlights (a) | |||||||||||||

| Whole gold equal ounces (b) | |||||||||||||

| Produced | 593,699 | 585,449 | 1,656,436 | 1,606,507 | |||||||||

| Offered | 578,323 | 571,248 | 1,621,483 | 1,614,547 | |||||||||

| Attributable gold equal ounces (b) | |||||||||||||

| Produced | 564,106 | 585,449 | 1,626,843 | 1,606,507 | |||||||||

| Offered | 550,548 | 571,248 | 1,593,708 | 1,614,547 | |||||||||

| Monetary Highlights (a) | |||||||||||||

| Metallic gross sales | $ | 1,432.0 | $ | 1,102.4 | $ | 3,733.0 | $ | 3,124.0 | |||||

| Manufacturing value of gross sales | $ | 564.3 | $ | 520.6 | $ | 1,613.3 | $ | 1,502.4 | |||||

| Depreciation, depletion and amortization | $ | 296.2 | $ | 263.9 | $ | 862.7 | $ | 715.1 | |||||

| Reversal of impairment cost | $ | (74.1 | ) | $ | – | $ | (74.1 | ) | $ | – | |||

| Working earnings | $ | 547.7 | $ | 226.2 | $ | 1,039.2 | $ | 607.9 | |||||

| Web earnings attributable to frequent shareholders | $ | 355.3 | $ | 109.7 | $ | 673.2 | $ | 350.9 | |||||

| Primary earnings per share attributable to frequent shareholders | $ | 0.29 | $ | 0.09 | $ | 0.55 | $ | 0.29 | |||||

| Diluted earnings per share attributable to frequent shareholders | $ | 0.29 | $ | 0.09 | $ | 0.55 | $ | 0.28 | |||||

| Adjusted web earnings attributable to frequent shareholders (c) | $ | 298.7 | $ | 144.6 | $ | 598.3 | $ | 399.8 | |||||

| Adjusted web earnings per share (c) | $ | 0.24 | $ | 0.12 | $ | 0.49 | $ | 0.33 | |||||

| Web money movement offered from working actions | $ | 733.5 | $ | 406.8 | $ | 1,711.9 | $ | 1,194.4 | |||||

| Attributable adjusted working money movement (c) | $ | 625.0 | $ | 472.1 | $ | 1,529.0 | $ | 1,267.1 | |||||

| Capital expenditures (d) | $ | 278.7 | $ | 283.9 | $ | 794.8 | $ | 787.0 | |||||

| Attributable capital expenditures (c) | $ | 275.5 | $ | 272.4 | $ | 772.1 | $ | 757.3 | |||||

| Attributable free money movement (c) | $ | 414.6 | $ | 137.7 | $ | 905.8 | $ | 443.0 | |||||

| Common realized gold worth per ounce (e) | $ | 2,477 | $ | 1,929 | $ | 2,304 | $ | 1,935 | |||||

| Manufacturing value of gross sales per equal ounce (b) bought (f) | $ | 976 | $ | 911 | $ | 995 | $ | 931 | |||||

| Attributable manufacturing value of gross sales per equal ounce (b) bought (c) | $ | 980 | $ | 911 | $ | 997 | $ | 931 | |||||

| Attributable manufacturing value of gross sales per ounce bought on a by-product foundation (c) | $ | 956 | $ | 860 | $ | 962 | $ | 876 | |||||

| Attributable all-in sustaining value per ounce bought on a by-product foundation (c) | $ | 1,332 | $ | 1,264 | $ | 1,324 | $ | 1,269 | |||||

| Attributable all-in sustaining value per equal ounce (b) bought (c) | $ | 1,350 | $ | 1,296 | $ | 1,349 | $ | 1,303 | |||||

| Attributable all-in value per ounce bought on a by-product foundation (c) | $ | 1,677 | $ | 1,561 | $ | 1,682 | $ | 1,590 | |||||

| Attributable all-in value per equal ounce (b) bought (c) | $ | 1,689 | $ | 1,579 | $ | 1,697 | $ | 1,608 | |||||

| (a) All measures and ratios embody 100% of the outcomes from Manh Choh, besides measures and ratios denoted as “attributable.” “Attributable” consists of Kinross’ 70% share of Manh Choh manufacturing, gross sales, money movement, capital expenditures and prices, as relevant. | |||||||||||||

| (b) “Gold equal ounces” embody silver ounces produced and bought transformed to a gold equal based mostly on a ratio of the typical spot market costs for the commodities for every interval. The ratio for the third quarter and first 9 months of 2024 was 84.06:1 and 84.34:1, respectively (third quarter and first 9 months of 2023 – 81.82:1 and 82.50:1, respectively). | |||||||||||||

| (c) The definition and reconciliation of those non-GAAP monetary measures and ratios is included on pages 15 to twenty of this information launch. Non-GAAP monetary measures and ratios haven’t any standardized which means beneath Worldwide Monetary Reporting Requirements (“IFRS”) and subsequently, will not be similar to comparable measures introduced by different issuers. | |||||||||||||

| (d) “Capital expenditures” is as reported as “Additions to property, plant and tools” on the interim condensed consolidated statements of money flows. | |||||||||||||

| (e) “Common realized gold worth per ounce” is outlined as gold steel gross sales divided by whole gold ounces bought. | |||||||||||||

| (f) “Manufacturing value of gross sales per equal ounce bought” is outlined as manufacturing value of gross sales divided by whole gold equal ounces bought. | |||||||||||||

The next working and monetary outcomes are based mostly on third-quarter gold equal manufacturing:

Manufacturing : Kinross produced 564,106 Au eq. oz. in Q3 2024, in contrast with 585,449 Au eq. oz. in Q3 2023. The 4% year-over-year lower was primarily a results of deliberate decrease manufacturing at Paracatu as a consequence of mine sequencing and fewer ounces recovered from the heap leach pads at Spherical Mountain, partially offset by the graduation of manufacturing from Manh Choh.

Common realized gold worth 5 : The common realized gold worth in Q3 2024 was $2,477 per ounce, in contrast with $1,929 per ounce in Q3 2023.

Income : In the course of the third quarter, income elevated to $1,432.0 million, in contrast with $1,102.4 million throughout Q3 2023.

Manufacturing value of gross sales : Manufacturing value of gross sales per Au eq. oz. bought was $976 for the quarter, in contrast with $911 in Q3 2023.

Attributable manufacturing value of gross sales per Au oz. bought on a by-product foundation 2 was $956 in Q3 2024, in contrast with $860 in Q3 2023, based mostly on attributable gold gross sales of 541,829 ounces and attributable silver gross sales of 732,857 ounces.

Margins 3 : Kinross’ margin per Au eq. oz. bought elevated by 47% to $1,501 for Q3 2024, in contrast with the Q3 2023 margin of $1,018, outpacing the 28% enhance in common realized gold worth 5 .

Attributable all-in sustaining value 2 : Attributable all-in sustaining value per Au eq. oz. bought was $1,350 in Q3 2024, in contrast with $1,296 in Q3 2023.

In Q3 2024, attributable all-in sustaining value per Au oz. bought on a by-product foundation was $1,332, in contrast with $1,264 in Q3 2023.

Working money movement : Working money movement was $733.5 million for Q3 2024, in contrast with $406.8 million for Q3 2023.

Attributable adjusted working money movement 2 for Q3 2024 was $625.0 million, in contrast with $472.1 million for Q3 2023.

Attributable free money movement 2 : Attributable free money movement tripled to a document $414.6 million in Q3 2024, in contrast with $137.7 million in Q3 2023. Yr-to-date attributable free money movement was $905.8 million.

Earnings : Reported web earnings greater than tripled to $355.3 million for Q3 2024, or $0.29 per share, in contrast with reported web earnings of $109.7 million, or $0.09 per share, for Q3 2023.

Adjusted web earnings 2 elevated to $298.7 million, or $0.24 per share 2 , for Q3 2024, in contrast with $144.6 million, or $0.12 per share 2 , for Q3 2023.

Attributable capital expenditures 2 : Attributable capital expenditures had been $275.5 million for Q3 2024, consistent with $272.4 million for Q3 2023.

Stability sheet

The Firm continued to strengthen its steadiness sheet by repaying $350.0 million on its time period mortgage within the quarter and an extra $100.0 million following the quarter. As of November 5, 2024, $650.0 million has been repaid on the $1.0 billion time period mortgage in 2024.

Kinross had money and money equivalents of $472.8 million as of September 30, 2024, in contrast with $352.4 million at December 31, 2023.

The Firm has further obtainable credit score 6 of $1.65 billion and whole liquidity 7 of roughly $2.1 billion.

On October 28, 2024, the Firm amended its $1,500.0 million revolving credit score facility to increase the maturity by two years to October 2029, restoring a five-year time period.

Dividend

As a part of its quarterly dividend program, the Board of Administrators declared a dividend of $0.03 per frequent share payable on December 12, 2024, to shareholders of document as of November 28, 2024.

Working outcomes

Mine-by-mine summaries for 2024 third-quarter working outcomes could also be discovered on pages 9 and 13 of this information launch. Highlights embody the next:

Tasiast delivered one other robust quarter, with manufacturing growing in contrast with Q2 2024 primarily as a consequence of document mill throughput, and price of gross sales per ounce bought elevated as a consequence of larger royalty prices regarding larger gold costs. Manufacturing decreased in contrast with Q3 2023 primarily because of a lower in mill grades, and price of gross sales per ounce bought was barely larger as a result of decrease manufacturing and better royalty prices.

At Paracatu , manufacturing elevated quarter-over-quarter primarily as a consequence of larger grades and recoveries because of the addition of Knelson gravity concentrators to the processing circuit, and price of gross sales per ounce bought decreased primarily as a result of larger manufacturing. Manufacturing was decrease in contrast with Q3 2023 primarily as a result of timing of ounces processed by means of the mill and decrease grades in line with the deliberate mine sequence. Value of gross sales per ounce bought was larger primarily as a result of deliberate lower in grades and manufacturing in contrast with Q3 2023.

At La Coipa , manufacturing was decrease quarter-over-quarter primarily as a consequence of decrease mill throughput and recoveries. Value of gross sales per ounce bought was larger quarter-over-quarter primarily as a result of decrease manufacturing. Yr-over-year, manufacturing decreased because of decrease mill throughput, and price of gross sales per ounce bought elevated primarily as a result of decrease manufacturing and better mill upkeep prices.

At La Coipa, mill throughput is being managed whereas optimization initiatives are carried out. Full-year manufacturing steerage at La Coipa stays on monitor.

At Fort Knox , manufacturing elevated considerably quarter-over-quarter and year-over-year as a result of graduation of manufacturing from higher-grade Manh Choh ore. Fort Knox realized document grade and restoration, leading to a big enhance in money movement. Value of gross sales per ounce bought decreased in each comparable intervals primarily as a result of enhance in manufacturing.

Development and commissioning of the Fort Knox mill modifications have been accomplished.

At Spherical Mountain , manufacturing decreased quarter-over-quarter and year-over-year primarily as a consequence of fewer ounces recovered from the heap leach pads. Value of gross sales per ounce bought was in line quarter-over-quarter and was larger year-over-year primarily as a result of lower in manufacturing and better value ounces produced from the heap leach pads.

At Spherical Mountain Part S , mining stays on monitor. Development of the heap leach pad growth is full, on schedule and beneath finances, with resolution utility permits acquired.

At Bald Mountain , manufacturing was decrease quarter-over-quarter as a result of timing of ounces produced from the heap leach pads. Manufacturing elevated year-over-year as a consequence of larger grades, partially offset by the timing of ounces recovered from the heap leach pads. Value of gross sales per ounce bought was larger in each comparable intervals because of larger value ounces produced from the heap leach pads.

Growth Initiatives and Exploration

Nice Bear

Kinross continues to make wonderful progress on the Nice Bear challenge.

Kinross launched the PEA for Nice Bear on September 10, 2024. The PEA offered visibility into the potential manufacturing scale, building capital, all-in sustaining value and margins for each the open pit and the underground. The PEA represents a cut-off date estimate and is barely a window into the long-term potential of the asset given the indications of continued mineralization at depth.

The PEA helps the Firm’s acquisition thesis of a top-tier, high-margin operation in a secure jurisdiction with robust infrastructure. Primarily based on mineral assets drilled to this point, the PEA outlines a high-grade mixed open pit and underground mine with an preliminary deliberate mine life of roughly 12 years and manufacturing value of gross sales of $594 per ounce. The Challenge is predicted to supply over 500,000 ounces per 12 months at an all-in sustaining value of roughly $800 per ounce through the first eight years by means of a traditional, modest capital 10,000 tonne per day mill 8 .

Kinross additionally launched an up to date mineral useful resource estimate for the challenge, growing the Inferred useful resource estimate by 568 koz. to three.9 Moz., which is along with the Measured & Indicated useful resource estimate of two.7 Moz. The mineral useful resource estimate and PEA for the Nice Bear challenge can be found right here .

For the AEX program, allowing, detailed engineering, execution planning, and procurement proceed to advance. Kinross has submitted its last Closure Plan to the Ontario Ministry of Mines and approval is predicted shortly. This is a crucial allow milestone that’s required for all AEX building actions. The Closure Plan will permit for the quick graduation of early works building on the location together with laydown areas, short-term workplaces, and earthworks.

The Firm is concentrated on progressing the AEX program to start drilling underground to proceed unlocking the complete potential of the asset, with building of the underground decline deliberate to begin in 2025.

For the Foremost Challenge, Kinross expects to advance engineering definition and execution planning following the number of design companions later this 12 months.

Following the receipt of the Tailor-made Impression Assertion Tips earlier this 12 months, the Firm continues to work with the Impression Evaluation Company of Canada on advancing its Impression Assertion, which is deliberate to be submitted later in 2025.

Kinross may even be working carefully with the Ontario authorities on acquiring provincial permits, much like the AEX permits, for the Foremost Challenge.

In 2025, Kinross intends to conduct regional exploration with the aim of figuring out new open pit and underground deposits.

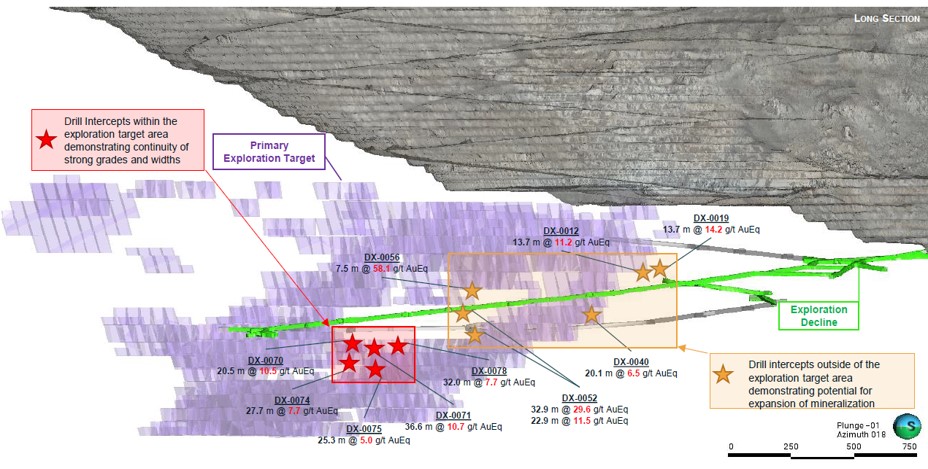

Spherical Mountain Part X

Infill drilling on the decrease zone of the first Part X exploration goal commenced in Q3, as deliberate, alongside continued alternative drilling outdoors the first Part X exploration goal.

The drilling in Q3 has demonstrated robust grades and widths from throughout the major Part X goal:

- DX-0071: 36.6m @ 10.9 g/t Au Eq.

- DX-0078: 32.0m @ 7.7 g/t Au Eq.

- DX-0070: 20.5m @ 10.5 g/t Au Eq.

- DX-0074: 27.7m @ 7.7 g/t Au Eq.

- DX-0075: 25.3m @ 5.0 g/t Au Eq.

- DX-0072: 20.4m @ 5.8 g/t Au Eq.

Drilling outdoors of the first exploration goal additionally continues to point robust grades and widths.

These outcomes proceed to help the Firm’s speculation of potential for higher-margin mining from a bulk underground operation.

See Appendix A for a Part X lengthy part.

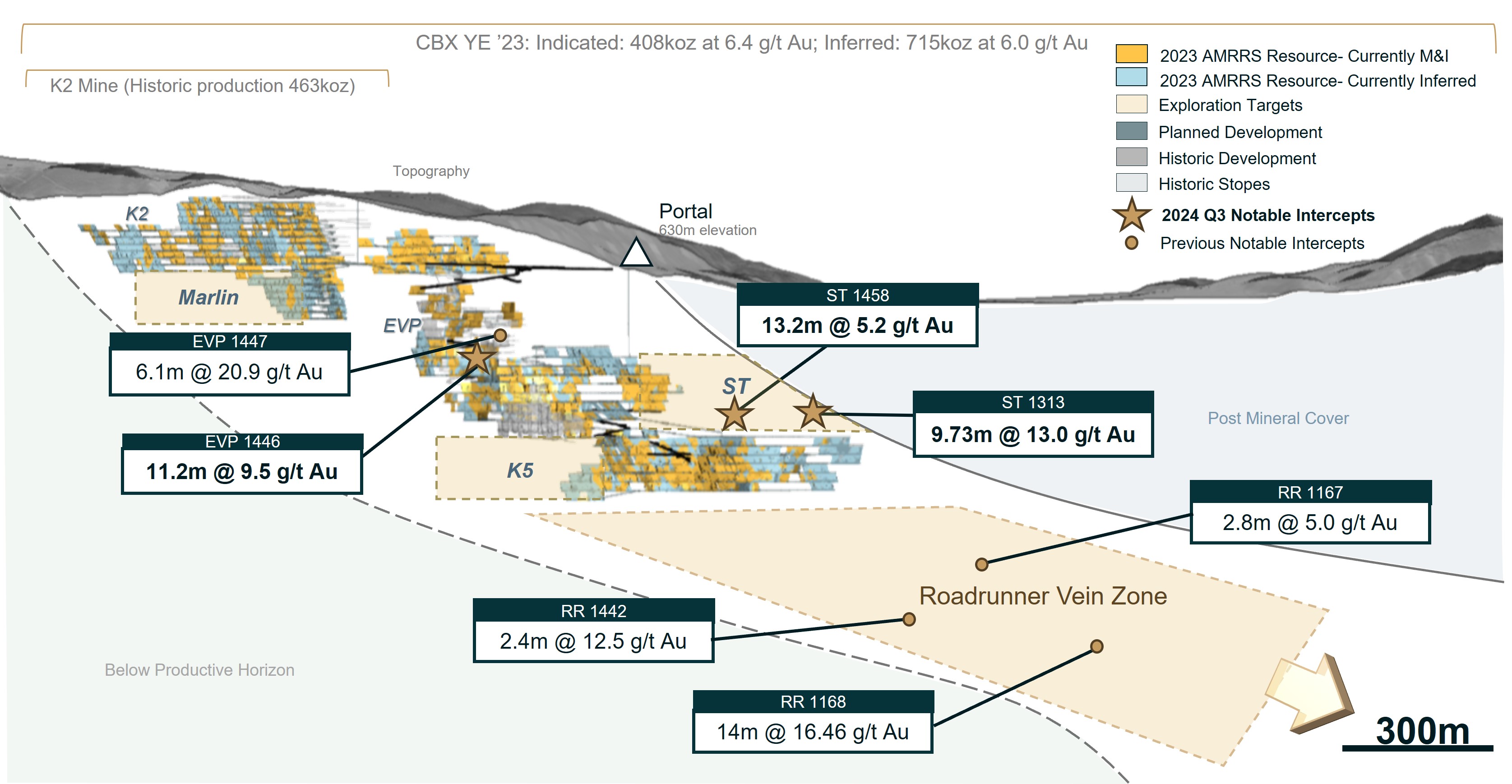

Curlew Basin exploration

At Curlew , drilling progressed within the third quarter with three drill rigs energetic underground testing the Stealth (ST) and EVP Zones. Highlights from holes drilled within the quarter embody (true widths):

- Gap 1313 returned 9.73m @ 13.00 g/t Au from the ST Zone

- Gap 1458 returned 13.20m @ 5.20 g/t Au from the ST Zone

- Gap 1446 returned 11.20m @ 9.50 g/t Au from the EVP Zone

Drilling this 12 months expanded mineralization in zones with beneficial grade and width to help higher-margin manufacturing.

See Appendix B for a Curlew Basin lengthy part.

Chile

Kinross is progressing baseline research at Lobo-Marte and continues to interact and construct relationships with communities and authorities stakeholders.

Lobo-Marte continues to be a possible giant, low-cost mine upon the conclusion of mining at La Coipa the place Kinross stays centered on potential alternatives to increase mine life.

Firm Steerage 4

The next part of the information launch represents forward-looking info and customers are cautioned that precise outcomes could range. We consult with the dangers and assumptions contained within the Cautionary Assertion on Ahead-Trying Data on pages 24 and 25.

Kinross is on monitor to fulfill its 2024 manufacturing steerage of two.1 million Au eq. oz. (+/- 5%), in addition to its manufacturing value of gross sales, all-in sustaining value and capital expenditure steerage ranges.

Kinross’ annual manufacturing is predicted to stay secure in 2025 and 2026 at roughly 2.0 million Au eq. oz. per 12 months.

Sustainability

Within the third quarter, Kinross continued to advance Sustainability initiatives. At Tasiast, and in partnership with native establishments, 90 apprentices acquired certificates of recognition for coaching aimed toward equipping younger Mauritanians with in-demand technical abilities in rising sectors resembling renewable vitality, electrical, mechanical, refrigeration and carpentry. Because the program’s inception in 2018, almost 350 younger individuals have accomplished their coaching.

Bald Mountain acquired the Nevada Mining Affiliation’s award for ‘Management in Concurrent Reclamation.’ The award acknowledges the profitable reclamation of a former heap leach facility that was regraded and revegetated in 2020, and at this time gives a pure ecosystem for livestock and wildlife.

Dedicated to advancing profession alternatives for girls in mining, Kinross nominated seven mentors and three mentees to the 2024 Worldwide Ladies in Mining Sources Mentoring Program. The Firm additionally not too long ago welcomed 30 new contributors to the internally developed Ladies at Kinross program, a six-month studying and training initiative now in its fourth cohort.

Convention name particulars

In reference to this information launch, Kinross will maintain a convention name and audio webcast on Wednesday, November 6, 2024, at 8:00 a.m. ET to debate the outcomes, adopted by a question-and-answer session. To entry the decision, please dial:

Canada & US toll-free – 1 (888) 596-4144; Passcode: 9135525

Exterior of Canada & US – 1 (646) 968-2525; Passcode: 9135525

Replay (obtainable as much as 14 days after the decision):

Canada & US toll-free – 1 (800) 770-2030; Passcode: 9135525

Exterior of Canada & US – 1 (647) 362-9199; Passcode: 9135525

You might also entry the convention name on a listen-only foundation through webcast at our web site www.kinross.com . The audio webcast can be archived on www.kinross.com .

About Kinross Gold Company

Kinross is a Canadian-based international senior gold mining firm with operations and initiatives in the USA, Brazil, Mauritania, Chile and Canada. Our focus is on delivering worth based mostly on the core rules of accountable mining, operational excellence, disciplined progress, and steadiness sheet energy. Kinross maintains listings on the Toronto Inventory Alternate (image: Ok) and the New York Inventory Alternate (image: KGC).

Media Contact

Victoria Barrington

Senior Director, Company Communications

cellphone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President

cellphone: 416-365-2761

InvestorRelations@kinross.com

Evaluation of operations

| Three months ended September 30, (unaudited) |

Gold equal ounces | ||||||||||||||||||

| Produced |

Offered |

Manufacturing value of gross sales ($thousands and thousands) |

Manufacturing value of gross sales/equal ounce bought |

||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 |

2023 | ||||||||||||

| Tasiast | 162,155 | 171,140 | 158,521 | 162,823 | 109.0 | 108.5 | 688 | 666 | |||||||||||

| Paracatu | 146,174 | 172,482 | 145,235 | 167,105 | 146.1 | 141.2 | 1,006 | 845 | |||||||||||

| La Coipa | 50,502 | 65,975 | 48,594 | 65,856 | 52.2 | 41.4 | 1,074 | 629 | |||||||||||

| Fort Knox | 149,093 | 71,611 | 140,121 | 71,616 | 134.2 | 82.3 | 958 | 1,149 | |||||||||||

| Spherical Mountain | 42,279 | 63,648 | 41,436 | 61,931 | 63.8 | 93.1 | 1,540 | 1,503 | |||||||||||

| Bald Mountain | 43,496 | 40,593 | 44,410 | 41,300 | 58.9 | 53.9 | 1,326 | 1,305 | |||||||||||

| United States Whole | 234,868 | 175,852 | 225,967 | 174,847 | 256.9 | 229.3 | 1,137 | 1,311 | |||||||||||

| Operations Whole (a) | 593,699 | 585,449 | 578,323 | 571,248 | 564.3 | 520.6 | 976 | 911 | |||||||||||

| Much less: Manh Choh non-controlling curiosity (30%) | (29,593 | ) | – | (27,775 | ) | – | (24.9 | ) | – | ||||||||||

| Attributable Whole (a) | 564,106 | 585,449 | 550,548 | 571,248 | 539.4 | 520.6 | 980 | 911 | |||||||||||

| 9 months ended September 30, (unaudited) |

Gold equal ounces | ||||||||||||||||||

| Produced | Offered | Manufacturing value of gross sales ($thousands and thousands) |

Manufacturing value of gross sales/equal ounce bought |

||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Tasiast | 482,983 | 460,029 | 465,573 | 443,866 | 311.0 | 296.4 | 668 | 668 | |||||||||||

| Paracatu | 404,675 | 460,059 | 403,519 | 459,338 | 417.0 | 394.4 | 1,033 | 859 | |||||||||||

| La Coipa | 187,598 | 186,315 | 183,225 | 195,014 | 163.1 | 129.9 | 890 | 666 | |||||||||||

| Fort Knox | 272,357 | 206,436 | 266,890 | 206,226 | 311.5 | 239.2 | 1,167 | 1,160 | |||||||||||

| Spherical Mountain | 172,418 | 179,926 | 169,654 | 177,569 | 248.3 | 275.1 | 1,464 | 1,549 | |||||||||||

| Bald Mountain | 136,405 | 113,742 | 131,469 | 130,764 | 161.6 | 166.4 | 1,229 | 1,273 | |||||||||||

| United States Whole | 581,180 | 500,104 | 568,013 | 514,559 | 721.4 | 680.7 | 1,270 | 1,323 | |||||||||||

| Operations Whole (a) | 1,656,436 | 1,606,507 | 1,621,483 | 1,614,547 | 1,613.3 | 1,502.4 | 995 | 931 | |||||||||||

| Much less: Manh Choh non-controlling curiosity (30%) | (29,593 | ) | – | (27,775 | ) | – | (24.9 | ) | – | ||||||||||

| Attributable Whole (a) | 1,626,843 | 1,606,507 | 1,593,708 | 1,614,547 | 1,588.4 | 1,502.4 | 997 | 931 | |||||||||||

| (a) Totals embody immaterial gross sales and associated prices from Maricunga for every interval introduced. | |||||||||||||||||||

Interim condensed consolidated steadiness sheets

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides share quantities) | |||||||||

| As at | |||||||||

| September 30, | December 31, | ||||||||

| 2024 | 2023 | ||||||||

| Belongings | |||||||||

| Present property | |||||||||

| Money and money equivalents | $ | 472.8 | $ | 352.4 | |||||

| Restricted money | 10.8 | 9.8 | |||||||

| Accounts receivable and different property | 307.6 | 268.7 | |||||||

| Present revenue tax recoverable | 1.1 | 3.4 | |||||||

| Inventories | 1,232.2 | 1,153.0 | |||||||

| Unrealized honest worth of by-product property | 5.6 | 15.0 | |||||||

| 2,030.1 | 1,802.3 | ||||||||

| Non-current property | |||||||||

| Property, plant and tools | 7,943.1 | 7,963.2 | |||||||

| Lengthy-term investments | 64.7 | 54.7 | |||||||

| Different long-term property | 707.9 | 710.6 | |||||||

| Deferred tax property | 12.6 | 12.5 | |||||||

| Whole property | $ | 10,758.4 | $ | 10,543.3 | |||||

| Liabilities | |||||||||

| Present liabilities | |||||||||

| Accounts payable and accrued liabilities | $ | 548.1 | $ | 531.5 | |||||

| Present revenue tax payable | 205.8 | 92.9 | |||||||

| Present portion of long-term debt and credit score services | 449.7 | – | |||||||

| Present portion of provisions | 51.1 | 48.8 | |||||||

| Different present liabilities | 7.9 | 12.3 | |||||||

| 1,262.6 | 685.5 | ||||||||

| Non-current liabilities | |||||||||

| Lengthy-term debt and credit score services | 1,235.0 | 2,232.6 | |||||||

| Provisions | 903.8 | 889.9 | |||||||

| Lengthy-term lease liabilities | 15.0 | 17.5 | |||||||

| Different long-term liabilities | 93.8 | 82.4 | |||||||

| Deferred tax liabilities | 455.4 | 449.7 | |||||||

| Whole liabilities | $ | 3,965.6 | $ | 4,357.6 | |||||

| Fairness | |||||||||

| Frequent shareholders’ fairness | |||||||||

| Frequent share capital | $ | 4,486.8 | $ | 4,481.6 | |||||

| Contributed surplus | 10,641.4 | 10,646.0 | |||||||

| Gathered deficit | (8,420.0 | ) | (8,982.6 | ) | |||||

| Gathered different complete loss | (62.3 | ) | (61.3 | ) | |||||

| Whole frequent shareholders’ fairness | 6,645.9 | 6,083.7 | |||||||

| Non-controlling pursuits | 146.9 | 102.0 | |||||||

| Whole fairness | $ | 6,792.8 | $ | 6,185.7 | |||||

| Whole liabilities and fairness | $ | 10,758.4 | $ | 10,543.3 | |||||

| Frequent shares | |||||||||

| Licensed | Limitless |

Limitless | |||||||

| Issued and excellent | 1,229,048,190 | 1,227,837,974 | |||||||

Interim condensed consolidated statements of operations

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides per share quantities) | |||||||||||||||||

| Three months ended | 9 months ended | ||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Income | |||||||||||||||||

| Metallic gross sales | $ | 1,432.0 | $ | 1,102.4 | $ | 3,733.0 | $ | 3,124.0 | |||||||||

| Value of gross sales | |||||||||||||||||

| Manufacturing value of gross sales | 564.3 | 520.6 | 1,613.3 | 1,502.4 | |||||||||||||

| Depreciation, depletion and amortization | 296.2 | 263.9 | 862.7 | 715.1 | |||||||||||||

| Reversal of impairment cost | (74.1 | ) | – | (74.1 | ) | – | |||||||||||

| Whole value of gross sales | 786.4 | 784.5 | 2,401.9 | 2,217.5 | |||||||||||||

| Gross revenue | 645.6 | 317.9 | 1,331.1 | 906.5 | |||||||||||||

| Different working expense | 21.1 | 14.9 | 50.6 | 82.1 | |||||||||||||

| Exploration and enterprise improvement | 49.6 | 51.0 | 147.0 | 134.3 | |||||||||||||

| Common and administrative | 27.2 | 25.8 | 94.3 | 82.2 | |||||||||||||

| Working earnings | 547.7 | 226.2 | 1,039.2 | 607.9 | |||||||||||||

| Different expense – web | (6.0 | ) | (0.3 | ) | (0.2 | ) | (6.3 | ) | |||||||||

| Finance revenue | 6.3 | 11.3 | 14.7 | 32.2 | |||||||||||||

| Finance expense | (23.5 | ) | (25.9 | ) | (66.8 | ) | (79.4 | ) | |||||||||

| Earnings earlier than tax | 524.5 | 211.3 | 986.9 | 554.4 | |||||||||||||

| Earnings tax expense – web | (134.2 | ) | (102.4 | ) | (281.1 | ) | (204.2 | ) | |||||||||

| Web earnings | $ | 390.3 | $ | 108.9 | $ | 705.8 | $ | 350.2 | |||||||||

| Web earnings (loss) attributable to: | |||||||||||||||||

| Non-controlling pursuits | $ | 35.0 | $ | (0.8 | ) | $ | 32.6 | $ | (0.7 | ) | |||||||

| Frequent shareholders | $ | 355.3 | $ | 109.7 | $ | 673.2 | $ | 350.9 | |||||||||

| Earnings per share attributable to frequent shareholders | |||||||||||||||||

| Primary | $ | 0.29 | $ | 0.09 | $ | 0.55 | $ | 0.29 | |||||||||

| Diluted | $ | 0.29 | $ | 0.09 | $ | 0.55 | $ | 0.28 | |||||||||

Interim condensed consolidated statements of money flows

| (unaudited, expressed in thousands and thousands of U.S. {dollars}) | |||||||||||||||||

| Three months ended | 9 months ended | ||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Web influx (outflow) of money associated to the next actions: | |||||||||||||||||

| Working: | |||||||||||||||||

| Web earnings | $ | 390.3 | $ | 108.9 | $ | 705.8 | $ | 350.2 | |||||||||

| Changes to reconcile web earnings to web money offered from working actions: | |||||||||||||||||

| Depreciation, depletion and amortization | 296.2 | 263.9 | 862.7 | 715.1 | |||||||||||||

| Reversal of impairment cost | (74.1 | ) | – | (74.1 | ) | – | |||||||||||

| Share-based compensation expense | 1.3 | 2.9 | 6.6 | 4.3 | |||||||||||||

| Finance expense | 23.5 | 25.9 | 66.8 | 79.4 | |||||||||||||

| Deferred tax expense | 21.6 | 74.1 | 9.0 | 92.8 | |||||||||||||

| International change losses and different | 8.9 | 13.0 | 16.8 | 34.8 | |||||||||||||

| Reclamation restoration | – | (18.1 | ) | – | (14.1 | ) | |||||||||||

| Adjustments in working property and liabilities: | |||||||||||||||||

| Accounts receivable and different property | (24.9 | ) | (21.0 | ) | 26.4 | 66.6 | |||||||||||

| Inventories | (11.5 | ) | (10.1 | ) | (3.1 | ) | (93.2 | ) | |||||||||

| Accounts payable and accrued liabilities | 121.4 | (15.0 | ) | 245.7 | 70.4 | ||||||||||||

| Money movement offered from working actions | 752.7 | 424.5 | 1,862.6 | 1,306.3 | |||||||||||||

| Earnings taxes paid | (19.2 | ) | (17.7 | ) | (150.7 | ) | (111.9 | ) | |||||||||

| Web money movement offered from working actions | 733.5 | 406.8 | 1,711.9 | 1,194.4 | |||||||||||||

| Investing: | |||||||||||||||||

| Additions to property, plant and tools | (278.7 | ) | (283.9 | ) | (794.8 | ) | (787.0 | ) | |||||||||

| Curiosity paid capitalized to property, plant and tools | (33.0 | ) | (43.0 | ) | (84.9 | ) | (89.8 | ) | |||||||||

| Web (additions) disposals to long-term investments and different property | (11.4 | ) | (2.5 | ) | (30.2 | ) | 2.4 | ||||||||||

| (Enhance) lower in restricted money – web | (1.3 | ) | (0.2 | ) | (1.0 | ) | 1.2 | ||||||||||

| Curiosity acquired and different – web | 6.0 | 6.6 | 13.7 | 13.5 | |||||||||||||

| Web money movement of continuous operations utilized in investing actions | (318.4 | ) | (323.0 | ) | (897.2 | ) | (859.7 | ) | |||||||||

| Web money movement of discontinued operations offered from investing actions | – | – | – | 45.0 | |||||||||||||

| Financing: | |||||||||||||||||

| Reimbursement of debt | (350.0 | ) | (550.0 | ) | (550.0 | ) | (770.0 | ) | |||||||||

| Proceeds from issuance or drawdown of debt | – | 488.1 | – | 588.1 | |||||||||||||

| Curiosity paid | (17.1 | ) | (26.5 | ) | (35.6 | ) | (53.0 | ) | |||||||||

| Cost of lease liabilities | (3.3 | ) | (4.4 | ) | (10.1 | ) | (25.5 | ) | |||||||||

| Funding from non-controlling curiosity | 4.1 | 27.0 | 31.3 | 38.8 | |||||||||||||

| Distributions to non-controlling curiosity | (19.5 | ) | – | (19.5 | ) | – | |||||||||||

| Dividends paid to frequent shareholders | (36.9 | ) | (36.8 | ) | (110.6 | ) | (110.5 | ) | |||||||||

| Different – web | 0.1 | 6.3 | 0.4 | (1.2 | ) | ||||||||||||

| Web money movement utilized in financing actions | (422.6 | ) | (96.3 | ) | (694.1 | ) | (333.3 | ) | |||||||||

| Impact of change charge modifications on money and money equivalents | 0.3 | (1.0 | ) | (0.2 | ) | 0.4 | |||||||||||

| (Lower) enhance in money and money equivalents | (7.2 | ) | (13.5 | ) | 120.4 | 46.8 | |||||||||||

| Money and money equivalents, starting of interval | 480.0 | 478.4 | 352.4 | 418.1 | |||||||||||||

| Money and money equivalents, finish of interval | $ | 472.8 | $ | 464.9 | $ | 472.8 | $ | 464.9 | |||||||||

| Working Abstract | |||||||||||||||||||||

| Mine | Interval | Tonnes Ore Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) |

Grade (Heap Leach) |

Restoration (a)(b) | Gold Eq Manufacturing (c) | Gold Eq Gross sales (c) |

Manufacturing value of gross sales |

Manufacturing value of gross sales/oz (d) |

Cap Ex – sustaining (e) | Whole Cap Ex (e) | DD&A | |||||||

| (‘000 tonnes) | (‘000 tonnes) | (‘000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ thousands and thousands) | ($/ounce) | ($ thousands and thousands) | ($ thousands and thousands) | ($ thousands and thousands) | |||||||||

| West Africa | Tasiast | Q3 2024 | 1,748 | 2,203 | – | 2.46 | – | 91 | % | 162,155 | 158,521 | $ | 109.0 | $ | 688 | $ | 13.5 | $ | 83.8 | $ | 94.3 |

| Q2 2024 | 1,985 | 2,161 | – | 2.70 | – | 92 | % | 161,629 | 156,038 | $ | 102.3 | $ | 656 | $ | 7.0 | $ | 75.2 | $ | 84.0 | ||

| Q1 2024 | 2,044 | 2,073 | – | 2.46 | – | 91 | % | 159,199 | 151,014 | $ | 99.7 | $ | 660 | $ | 10.1 | $ | 79.5 | $ | 77.9 | ||

| This fall 2023 | 2,937 | 2,056 | – | 3.04 | – | 93 | % | 160,764 | 171,199 | $ | 110.4 | $ | 645 | $ | 9.7 | $ | 85.2 | $ | 70.6 | ||

| Q3 2023 | 3,486 | 1,796 | – | 3.10 | – | 92 | % | 171,140 | 162,823 | $ | 108.5 | $ | 666 | $ | 12.2 | $ | 77.3 | $ | 69.0 | ||

| Americas | Paracatu | Q3 2024 | 13,127 | 14,551 | – | 0.38 | – | 81 | % | 146,174 | 145,235 | $ | 146.1 | $ | 1,006 | $ | 41.2 | $ | 41.2 | $ | 52.6 |

| Q2 2024 | 14,094 | 15,053 | – | 0.35 | – | 80 | % | 130,228 | 130,174 | $ | 135.2 | $ | 1,039 | $ | 44.6 | $ | 44.6 | $ | 45.7 | ||

| Q1 2024 | 14,078 | 15,609 | – | 0.31 | – | 79 | % | 128,273 | 128,110 | $ | 135.7 | $ | 1,059 | $ | 19.6 | $ | 19.6 | $ | 46.7 | ||

| This fall 2023 | 16,865 | 15,279 | – | 0.35 | – | 79 | % | 127,940 | 132,886 | $ | 144.2 | $ | 1,085 | $ | 41.6 | $ | 41.6 | $ | 43.3 | ||

| Q3 2023 | 14,725 | 14,669 | – | 0.41 | – | 79 | % | 172,482 | 167,105 | $ | 141.2 | $ | 845 | $ | 58.4 | $ | 58.4 | $ | 53.1 | ||

| La Coipa (f) | Q3 2024 | 786 | 809 | – | 2.17 | – | 80 | % | 50,502 | 48,594 | $ | 52.2 | $ | 1,074 | $ | 21.3 | $ | 24.9 | $ | 33.5 | |

| Q2 2024 | 690 | 882 | – | 1.97 | – | 84 | % | 65,851 | 63,506 | $ | 58.8 | $ | 926 | $ | 10.7 | $ | 10.7 | $ | 45.8 | ||

| Q1 2024 | 1,035 | 827 | – | 2.09 | – | 87 | % | 71,245 | 71,125 | $ | 52.1 | $ | 733 | $ | 7.2 | $ | 7.2 | $ | 50.0 | ||

| This fall 2023 | 1,591 | 1,188 | – | 1.92 | – | 78 | % | 73,823 | 73,477 | $ | 52.9 | $ | 720 | $ | 7.0 | $ | 10.9 | $ | 54.8 | ||

| Q3 2023 | 1,137 | 1,017 | – | 1.69 | – | 81 | % | 65,975 | 65,856 | $ | 41.4 | $ | 629 | $ | 7.5 | $ | 15.2 | $ | 48.3 | ||

| Fort Knox (100%) (g) | Q3 2024 | 7,612 | 1,105 | 5,822 | 4.03 | 0.19 | 91 | % | 149,093 | 140,121 | $ | 134.2 | $ | 958 | $ | 56.6 | $ | 70.4 | $ | 37.2 | |

| Q2 2024 | 8,331 | 2,003 | 6,385 | 0.85 | 0.22 | 81 | % | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 89.2 | $ | 25.9 | ||

| Q1 2024 | 10,037 | 1,850 | 8,778 | 0.67 | 0.24 | 76 | % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 78.6 | $ | 20.5 | ||

| This fall 2023 | 11,018 | 2,173 | 9,930 | 0.69 | 0.22 | 78 | % | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 114.3 | $ | 31.5 | ||

| Q3 2023 | 6,667 | 1,912 | 5,961 | 0.81 | 0.21 | 78 | % | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 96.0 | $ | 24.6 | ||

| Fort Knox (attributable) (g) | Q3 2024 | 7,509 | 991 | 5,822 | 3.44 | 0.19 | 91 | % | 119,500 | 112,346 | $ | 109.3 | $ | 973 | $ | 55.4 | $ | 67.2 | $ | 31.5 | |

| Q2 2024 | 8,249 | 2,003 | 6,385 | 0.85 | 0.22 | 81 | % | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 79.5 | $ | 25.9 | ||

| Q1 2024 | 10,009 | 1,850 | 8,778 | 0.67 | 0.24 | 76 | % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 68.8 | $ | 20.5 | ||

| This fall 2023 | 11,014 | 2,173 | 9,930 | 0.69 | 0.22 | 78 | % | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 100.7 | $ | 31.5 | ||

| Q3 2023 | 6,667 | 1,912 | 5,961 | 0.81 | 0.21 | 78 | % | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 84.5 | $ | 24.6 | ||

| Spherical Mountain | Q3 2024 | 2,958 | 790 | 1,032 | 0.74 | 0.29 | 80 | % | 42,279 | 41,436 | $ | 63.8 | $ | 1,540 | $ | 5.2 | $ | 35.9 | $ | 37.4 | |

| Q2 2024 | 2,956 | 806 | 1,541 | 1.11 | 0.35 | 73 | % | 61,787 | 60,049 | $ | 93.9 | $ | 1,564 | $ | 2.1 | $ | 37.2 | $ | 65.9 | ||

| Q1 2024 | 4,246 | 960 | 3,257 | 1.32 | 0.37 | 73 | % | 68,352 | 68,169 | $ | 90.6 | $ | 1,329 | $ | 3.7 | $ | 19.3 | $ | 47.3 | ||

| This fall 2023 | 4,666 | 884 | 2,729 | 0.91 | 0.48 | 68 | % | 55,764 | 56,495 | $ | 82.6 | $ | 1,462 | $ | 4.6 | $ | 4.8 | $ | 45.0 | ||

| Q3 2023 | 8,474 | 911 | 7,644 | 0.75 | 0.38 | 75 | % | 63,648 | 61,931 | $ | 93.1 | $ | 1,503 | $ | 7.7 | $ | 7.8 | $ | 44.1 | ||

| Bald Mountain | Q3 2024 | 6,384 | – | 6,384 | – | 0.53 | nm | 43,496 | 44,410 | $ | 58.9 | $ | 1,326 | $ | 5.0 | $ | 6.1 | $ | 39.7 | ||

| Q2 2024 | 2,906 | – | 2,906 | – | 0.47 | nm | 45,929 | 39,818 | $ | 50.6 | $ | 1,271 | $ | 4.4 | $ | 4.6 | $ | 27.0 | |||

| Q1 2024 | 1,480 | – | 1,480 | – | 0.42 | nm | 46,980 | 47,241 | $ | 52.1 | $ | 1,103 | $ | 32.4 | $ | 32.4 | $ | 27.0 | |||

| This fall 2023 | 3,894 | – | 3,918 | – | 0.47 | nm | 44,007 | 49,375 | $ | 57.1 | $ | 1,156 | $ | 36.3 | $ | 38.8 | $ | 25.0 | |||

| Q3 2023 | 7,412 | – | 7,412 | – | 0.39 | nm | 40,593 | 41,300 | $ | 53.9 | $ | 1,305 | $ | 20.6 | $ | 24.9 | $ | 23.3 | |||

| (a) Because of the nature of heap leach operations, restoration charges at Bald Mountain can’t be precisely measured on a quarterly foundation. Restoration charges at Fort Knox and Spherical Mountain signify mill restoration solely. | |||||||||||||||||||||

| (b) “nm” means not significant. |

|||||||||||||||||||||

| (c) Gold equal ounces embody silver ounces produced and bought transformed to a gold equal based mostly on the ratio of the typical spot market costs for the commodities for every interval. The ratios for the quarters introduced are as follows: Q3 2024: 84.06:1; Q2 2024: 81.06:1; Q1 2024: 88.70:1; This fall 2023: 85.00:1; Q3 2023: 81.82:1. | |||||||||||||||||||||

| (d) “Manufacturing value of gross sales per equal ounce bought” is outlined as manufacturing value of gross sales divided by whole gold equal ounces bought. | |||||||||||||||||||||

| (e) “Whole Cap Ex” is as reported as “Additions to property, plant and tools” on the interim condensed consolidated statements of money flows. “Cap Ex – sustaining” is a non-GAAP monetary measure. The definition and reconciliation of this non-GAAP monetary measure is included on pages 19 and 20 of this information launch | |||||||||||||||||||||

| (f) La Coipa silver grade and restoration had been as follows: Q3 2024: 49.13 g/t, 58%; Q2 2024: 65.02 g/t, 51%; Q1 2024: 87.20 g/t, 58%; This fall 2023: 96.24 g/t, 44%; Q3 2023: 106.70 g/t, 63%. | |||||||||||||||||||||

| (g) The Fort Knox section consists of Fort Knox and Manh Choh, and comparative outcomes proven are introduced in accordance with the present 12 months’s presentation. Manh Choh tonnes of ore processed and grade had been 379,786 and 9.13, respectively, for Q3 2024 and nil for all different intervals introduced as manufacturing commenced in July 2024. The attributable outcomes for Fort Knox embody 100% of Fort Knox and 70% of Manh Choh. | |||||||||||||||||||||

Reconciliation of non-GAAP monetary measures and ratios

The Firm has included sure non-GAAP monetary measures and ratios on this doc. These monetary measures and ratios will not be outlined beneath IFRS and shouldn’t be thought-about in isolation. The Firm believes that these monetary measures and ratios, along with monetary measures and ratios decided in accordance with IFRS, present traders with an improved potential to judge the underlying efficiency of the Firm. The inclusion of those monetary measures and ratios is supposed to offer further info and shouldn’t be used as an alternative choice to efficiency measures ready in accordance with IFRS. These monetary measures and ratios will not be essentially customary and subsequently will not be similar to different issuers.

Adjusted Web Earnings Attributable to Frequent Shareholders and Adjusted Web Earnings per Share

Adjusted web earnings attributable to frequent shareholders and adjusted web earnings per share are non-GAAP monetary measures and ratios which decide the efficiency of the Firm, excluding sure impacts which the Firm believes will not be reflective of the Firm’s underlying efficiency for the reporting interval, such because the influence of overseas change features and losses, reassessment of prior 12 months taxes and/or taxes in any other case not associated to the present interval, impairment prices (reversals), features and losses and different one-time prices associated to acquisitions, tendencies and different transactions, and non-hedge by-product features and losses. Though a few of the gadgets are recurring, the Firm believes that they don’t seem to be reflective of the underlying working efficiency of its present enterprise and will not be essentially indicative of future working outcomes. Administration believes that these measures and ratios, that are used internally to evaluate efficiency and in planning and forecasting future working outcomes, present traders with the power to higher consider underlying efficiency, notably because the excluded gadgets are sometimes not included in public steerage. Nonetheless, adjusted web earnings and adjusted web earnings per share measures and ratios will not be essentially indicative of web earnings and earnings per share measures and ratios as decided beneath IFRS.

The next desk gives a reconciliation of web earnings to adjusted web earnings for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides per share quantities) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Web earnings attributable to frequent shareholders – as reported | $ | 355.3 | $ | 109.7 | $ | 673.2 | $ | 350.9 | ||||||

| Adjusting gadgets: | ||||||||||||||

| International change losses (features) | 4.8 | (7.1 | ) | (5.1 | ) | (0.8 | ) | |||||||

| International change losses on translation of tax foundation and overseas change on deferred revenue taxes inside revenue tax expense | 7.7 | 36.9 | 32.0 | 5.2 | ||||||||||

| Taxes in respect of prior intervals | (0.2 | ) | 5.2 | (22.9 | ) | 33.8 | ||||||||

| Reversal of impairment cost | (74.1 | ) | – | (74.1 | ) | – | ||||||||

| Insurance coverage recoveries | – | (0.5 | ) | (22.9 | ) | (1.2 | ) | |||||||

| Different (a) | 0.8 | (1.4 | ) | 16.2 | 13.7 | |||||||||

| Tax results of the above changes | 4.4 | 1.8 | 1.9 | (1.8 | ) | |||||||||

| (56.6 | ) | 34.9 | (74.9 | ) | 48.9 | |||||||||

| Adjusted web earnings attributable to frequent shareholders | $ | 298.7 | $ | 144.6 | $ | 598.3 | $ | 399.8 | ||||||

| Weighted common variety of frequent shares excellent – Primary | 1,229.0 | 1,227.6 | 1,228.8 | 1,226.7 | ||||||||||

| Adjusted web earnings per share | $ | 0.24 | $ | 0.12 | $ | 0.49 | $ | 0.33 | ||||||

| Primary earnings per share attributable to frequent shareholders – as reported | $ | 0.29 | $ | 0.09 | $ | 0.55 | $ | 0.29 | ||||||

| (a) Different consists of varied impacts, resembling one-time prices at websites, restructuring prices, authorized settlements and features and losses on hedges and the sale of property, which the Firm believes will not be reflective of the Firm’s underlying efficiency for the reporting interval. | ||||||||||||||

Attributable Free Money Stream

Attributable free money movement is a non-GAAP monetary measure and is outlined as web money movement offered from working actions much less attributable capital expenditures and non-controlling curiosity included in web money flows offered from working actions. The Firm believes that this measure, which is used internally to judge the Firm’s underlying money era efficiency and the power to repay collectors and return money to shareholders, gives traders with the power to higher consider the Firm’s underlying efficiency. Nonetheless, this measure shouldn’t be essentially indicative of working earnings or web money movement offered from working actions as decided beneath IFRS.

The next desk gives a reconciliation of attributable free money movement for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Web money movement offered from working actions – as reported | $ | 733.5 | $ | 406.8 | $ | 1,711.9 | $ | 1,194.4 | ||||||

| Adjusting gadgets: | ||||||||||||||

| Attributable (a) capital expenditures | (275.5 | ) | (272.4 | ) | (772.1 | ) | (757.3 | ) | ||||||

| Non-controlling curiosity (b) money movement utilized in working actions | (43.4 | ) | 3.3 | (34.0 | ) | 5.9 | ||||||||

| Attributable (a) free money movement | $ | 414.6 | $ | 137.7 | $ | 905.8 | $ | 443.0 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Attributable Adjusted Working Money Stream

Attributable adjusted working money movement is a non-GAAP monetary measure and is outlined as web money movement offered from working actions excluding modifications in working capital, sure impacts which the Firm believes will not be reflective of the Firm’s common working money movement, and web money flows offered from working actions, web of working capital modifications, regarding non-controlling pursuits. Working capital will be unstable as a consequence of quite a few elements, together with the timing of tax funds. The Firm makes use of attributable adjusted working money movement internally as a measure of the underlying working money movement efficiency and future working money flow-generating functionality of the Firm. Nonetheless, the attributable adjusted working money movement measure shouldn’t be essentially indicative of web money movement offered from working actions as decided beneath IFRS.

The next desk gives a reconciliation of attributable adjusted working money movement for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Web money movement offered from working actions – as reported | $ | 733.5 | $ | 406.8 | $ | 1,711.9 | $ | 1,194.4 | ||||||

| Adjusting gadgets: | ||||||||||||||

| Insurance coverage proceeds acquired in respect of prior years | – | – | (22.9 | ) | – | |||||||||

| Working capital modifications: | ||||||||||||||

| Accounts receivable and different property | 24.9 | 21.0 | (26.4 | ) | (66.6 | ) | ||||||||

| Inventories | 11.5 | 10.1 | 3.1 | 93.2 | ||||||||||

| Accounts payable and different liabilities, together with revenue taxes paid | (102.2 | ) | 32.7 | (95.0 | ) | 41.5 | ||||||||

| 667.7 | 470.6 | 1,570.7 | 1,262.5 | |||||||||||

| Non-controlling curiosity (b) money movement utilized in working actions, web of working capital modifications | (42.7 | ) | 1.5 | (41.7 | ) | 4.6 | ||||||||

| Attributable (a) adjusted working money movement | $ | 625.0 | $ | 472.1 | $ | 1,529.0 | $ | 1,267.1 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Manufacturing Value of Gross sales and Attributable Manufacturing Value of Gross sales per Equal Ounce Offered

Manufacturing value of gross sales per equal ounce bought is outlined as manufacturing value of gross sales, as reported on the consolidated assertion of operations, divided by the full variety of gold equal ounces bought. This measure converts the Firm’s non-gold manufacturing into gold equal ounces and credit it to whole manufacturing.

Attributable manufacturing value of gross sales per equal ounce bought is a non-GAAP ratio and is outlined as attributable manufacturing value of gross sales divided by the attributable variety of gold equal ounces bought. This measure converts the Firm’s non-gold manufacturing into gold equal ounces and credit it to whole manufacturing. Administration makes use of this measure to watch and consider the efficiency of its working properties which can be attributable to its shareholders.

The next desk gives a reconciliation of manufacturing value of gross sales and attributable manufacturing value of gross sales per equal ounce bought for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides ounces and manufacturing value of gross sales per equal ounce) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Manufacturing value of gross sales – as reported | $ | 564.3 | $ | 520.6 | $ | 1,613.3 | $ | 1,502.4 | ||||||

| Much less: non-controlling curiosity (b) manufacturing value of gross sales | (24.9 | ) | – | (24.9 | ) | – | ||||||||

| Attributable (a) manufacturing value of gross sales | $ | 539.4 | $ | 520.6 | $ | 1,588.4 | $ | 1,502.4 | ||||||

| Gold equal ounces bought | 578,323 | 571,248 | 1,621,483 | 1,614,547 | ||||||||||

| Much less: non-controlling curiosity (b) gold equal ounces bought | (27,775 | ) | – | (27,775 | ) | – | ||||||||

| Attributable (a) gold equal ounces bought | 550,548 | 571,248 | 1,593,708 | 1,614,547 | ||||||||||

| Attributable (a) manufacturing value of gross sales per equal ounce bought | $ | 980 | $ | 911 | $ | 997 | $ | 931 | ||||||

| Manufacturing value of gross sales per equal ounce bought (c) | $ | 976 | $ | 911 | $ | 995 | $ | 931 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Attributable Manufacturing Value of Gross sales per Ounce Offered on a By-Product Foundation

Attributable manufacturing value of gross sales per ounce bought on a by-product foundation is a non-GAAP ratio which calculates the Firm’s non-gold manufacturing as a credit score in opposition to its per ounce manufacturing prices, fairly than changing its non-gold manufacturing into gold equal ounces and crediting it to whole manufacturing, as is the case in co-product accounting. Administration believes that this ratio gives traders with the power to higher consider Kinross’ manufacturing value of gross sales per ounce on a comparable foundation with different main gold producers who routinely calculate their value of gross sales per ounce utilizing by-product accounting fairly than co-product accounting.

The next desk gives a reconciliation of attributable manufacturing value of gross sales per ounce bought on a by-product foundation for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides ounces and manufacturing value of gross sales per ounce) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Manufacturing value of gross sales – as reported | $ | 564.3 | $ | 520.6 | $ | 1,613.3 | $ | 1,502.4 | ||||||

| Much less: non-controlling curiosity (b) manufacturing value of gross sales | (24.9 | ) | – | (24.9 | ) | – | ||||||||

| Much less: attributable (a) silver income (d) | (21.4 | ) | (52.4 | ) | (97.2 | ) | (160.6 | ) | ||||||

| Attributable (a) manufacturing value of gross sales web of silver by-product income | $ | 518.0 | $ | 468.2 | $ | 1,491.2 | $ | 1,341.8 | ||||||

| Gold ounces bought | 569,506 | 544,199 | 1,578,232 | 1,531,816 | ||||||||||

| Much less: non-controlling curiosity (b) gold ounces bought | (27,676 | ) | – | (27,676 | ) | – | ||||||||

| Attributable (a) gold ounces bought | 541,830 | 544,199 | 1,550,556 | 1,531,816 | ||||||||||

| Attributable (a) manufacturing value of gross sales per ounce bought on a by-product foundation | $ | 956 | $ | 860 | $ | 962 | $ | 876 | ||||||

| Manufacturing value of gross sales per equal ounce bought (c) | $ | 976 | $ | 911 | $ | 995 | $ | 931 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Attributable All-In Sustaining Value and All-In Value per Ounce Offered on a By-Product Foundation

Attributable all-in sustaining value and all-in value per ounce bought on a by-product foundation are non-GAAP monetary measures and ratios, as relevant, calculated based mostly on steerage printed by the World Gold Council (“WGC”). The WGC is a market improvement group for the gold business and is an affiliation whose membership includes main gold mining corporations together with Kinross. Though the WGC shouldn’t be a mining business regulatory group, it labored carefully with its member corporations to develop these metrics. Adoption of the all-in sustaining value and all-in value metrics is voluntary and never essentially customary, and subsequently, these measures and ratios introduced by the Firm will not be similar to comparable measures and ratios introduced by different issuers. The Firm believes that the all-in sustaining value and all-in value measures complement present measures and ratios reported by Kinross.

All-in sustaining value consists of each working and capital prices required to maintain gold manufacturing on an ongoing foundation. The worth of silver bought is deducted from the full manufacturing value of gross sales as it’s thought-about residual manufacturing, i.e. a by-product. Sustaining working prices signify expenditures incurred at present operations which can be thought-about mandatory to keep up present manufacturing. Sustaining capital represents capital expenditures at present operations comprising mine improvement prices, together with capitalized improvement, and ongoing substitute of mine tools and different capital services, and doesn’t embody capital expenditures for main progress initiatives or enhancement capital for vital infrastructure enhancements at present operations.

All-in value is comprised of all-in sustaining value in addition to working expenditures incurred at areas with no present operation, or prices associated to different non-sustaining actions, and capital expenditures for main progress initiatives or enhancement capital for vital infrastructure enhancements at present operations.

Attributable all-in sustaining value and all-in value per ounce bought on a by-product foundation are calculated by adjusting manufacturing value of gross sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides ounces and prices per ounce) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Manufacturing value of gross sales – as reported | $ | 564.3 | $ | 520.6 | $ | 1,613.3 | $ | 1,502.4 | ||||||

| Much less: non-controlling curiosity (b) manufacturing value of gross sales | (24.9 | ) | – | (24.9 | ) | – | ||||||||

| Much less: attributable (a) silver income (d) | (21.4 | ) | (52.4 | ) | (97.2 | ) | (160.6 | ) | ||||||

| Attributable (a) manufacturing value of gross sales web of silver by-product income | $ | 518.0 | $ | 468.2 | $ | 1,491.2 | $ | 1,341.8 | ||||||

| Adjusting gadgets on an attributable (a) foundation: | ||||||||||||||

| Common and administrative (e) | 27.2 | 24.0 | 90.3 | 80.4 | ||||||||||

| Different working expense – sustaining (f) | 2.5 | 6.3 | 4.9 | 17.8 | ||||||||||

| Reclamation and remediation – sustaining (g) | 18.4 | 14.1 | 56.1 | 46.8 | ||||||||||

| Exploration and enterprise improvement – sustaining (h) | 10.6 | 11.8 | 32.4 | 27.9 | ||||||||||

| Additions to property, plant and tools – sustaining (i) | 141.8 | 159.1 | 367.6 | 404.2 | ||||||||||

| Lease funds – sustaining (j) | 3.2 | 4.2 | 9.9 | 24.9 | ||||||||||

| All-in Sustaining Value on a by-product foundation – attributable (a) | $ | 721.7 | $ | 687.7 | $ | 2,052.4 | $ | 1,943.8 | ||||||

| Adjusting gadgets on an attributable (a) foundation: | ||||||||||||||

| Different working expense – non-sustaining (f) | 12.9 | 8.7 | 32.8 | 27.4 | ||||||||||

| Reclamation and remediation – non-sustaining (g) | 1.7 | 1.2 | 5.1 | 5.4 | ||||||||||

| Exploration and enterprise improvement – non-sustaining (h) | 38.3 | 38.5 | 113.0 | 105.8 | ||||||||||

| Additions to property, plant and tools – non-sustaining (i) | 133.7 | 113.3 | 404.5 | 353.1 | ||||||||||

| Lease funds – non-sustaining (j) | 0.1 | 0.2 | 0.2 | 0.6 | ||||||||||

| All-in Value on a by-product foundation – attributable (a) | $ | 908.4 | $ | 849.6 | $ | 2,608.0 | $ | 2,436.1 | ||||||

| Gold ounces bought | 569,506 | 544,199 | 1,578,232 | 1,531,816 | ||||||||||

| Much less: non-controlling curiosity (b) gold ounces bought | (27,676 | ) | – | (27,676 | ) | – | ||||||||

| Attributable (a) gold ounces bought | 541,830 | 544,199 | 1,550,556 | 1,531,816 | ||||||||||

| Attributable (a) all-in sustaining value per ounce bought on a by-product foundation | $ | 1,332 | $ | 1,264 | $ | 1,324 | $ | 1,269 | ||||||

| Attributable (a) all-in value per ounce bought on a by-product foundation | $ | 1,677 | $ | 1,561 | $ | 1,682 | $ | 1,590 | ||||||

| Manufacturing value of gross sales per equal ounce bought (c) | $ | 976 | $ | 911 | $ | 995 | $ | 931 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Attributable All-In Sustaining Value and All-In Value per Equal Ounce Offered

The Firm additionally assesses its attributable all-in sustaining value and all-in value on a gold equal ounce foundation. Beneath these non-GAAP monetary measures and ratios, the Firm’s manufacturing of silver is transformed into gold equal ounces and credited to whole manufacturing.

Attributable all-in sustaining value and all-in value per equal ounce bought are calculated by adjusting manufacturing value of gross sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}, besides ounces and prices per ounce) | Three months ended | 9 months ended | ||||||||||||

| September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Manufacturing value of gross sales – as reported | $ | 564.3 | $ | 520.6 | $ | 1,613.3 | $ | 1,502.4 | ||||||

| Much less: non-controlling curiosity (b) manufacturing value of gross sales | (24.9 | ) | – | (24.9 | ) | – | ||||||||

| Attributable (a) manufacturing value of gross sales | $ | 539.4 | $ | 520.6 | $ | 1,588.4 | $ | 1,502.4 | ||||||

| Adjusting gadgets on an attributable (a) foundation: | ||||||||||||||

| Common and administrative (e) | 27.2 | 24.0 | 90.3 | 80.4 | ||||||||||

| Different working expense – sustaining (f) | 2.5 | 6.3 | 4.9 | 17.8 | ||||||||||

| Reclamation and remediation – sustaining (g) | 18.4 | 14.1 | 56.1 | 46.8 | ||||||||||

| Exploration and enterprise improvement – sustaining (h) | 10.6 | 11.8 | 32.4 | 27.9 | ||||||||||

| Additions to property, plant and tools – sustaining (i) | 141.8 | 159.1 | 367.6 | 404.2 | ||||||||||

| Lease funds – sustaining (j) | 3.2 | 4.2 | 9.9 | 24.9 | ||||||||||

| All-in Sustaining Value – attributable (a) | $ | 743.1 | $ | 740.1 | $ | 2,149.6 | $ | 2,104.4 | ||||||

| Adjusting gadgets on an attributable (a) foundation: | ||||||||||||||

| Different working expense – non-sustaining (f) | 12.9 | 8.7 | 32.8 | 27.4 | ||||||||||

| Reclamation and remediation – non-sustaining (g) | 1.7 | 1.2 | 5.1 | 5.4 | ||||||||||

| Exploration and enterprise improvement – non-sustaining (h) | 38.3 | 38.5 | 113.0 | 105.8 | ||||||||||

| Additions to property, plant and tools – non-sustaining (i) | 133.7 | 113.3 | 404.5 | 353.1 | ||||||||||

| Lease funds – non-sustaining (j) | 0.1 | 0.2 | 0.2 | 0.6 | ||||||||||

| All-in Value – attributable (a) | $ | 929.8 | $ | 902.0 | $ | 2,705.2 | $ | 2,596.7 | ||||||

| Gold equal ounces bought | 578,323 | 571,248 | 1,621,483 | 1,614,547 | ||||||||||

| Much less: non-controlling curiosity (b) gold equal ounces bought | (27,775 | ) | – | (27,775 | ) | – | ||||||||

| Attributable (a) gold equal ounces bought | 550,548 | 571,248 | 1,593,708 | 1,614,547 | ||||||||||

| Attributable (a) all-in sustaining value per equal ounce bought | $ | 1,350 | $ | 1,296 | $ | 1,349 | $ | 1,303 | ||||||

| Attributable (a) all-in value per equal ounce bought | $ | 1,689 | $ | 1,579 | $ | 1,697 | $ | 1,608 | ||||||

| Manufacturing value of gross sales per equal ounce bought (c) | $ | 976 | $ | 911 | $ | 995 | $ | 931 | ||||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||

Capital Expenditures and Attributable Capital Expenditures

Capital expenditures are labeled as both sustaining capital expenditures or non-sustaining capital expenditures, relying on the character of the expenditure. Sustaining capital expenditures sometimes signify capital expenditures at present operations together with capitalized exploration prices and capitalized improvement until associated to main initiatives, ongoing substitute of mine tools and different capital services and different capital expenditures and is calculated as whole additions to property, plant and tools (as reported on the interim condensed consolidated statements of money flows), much less non-sustaining capital expenditures. Non-sustaining capital expenditures signify capital expenditures for main initiatives, together with main capital improvement initiatives at present operations which can be anticipated to materially profit the operation, in addition to enhancement capital for vital infrastructure enhancements at present operations. Administration believes the excellence between sustaining capital expenditures and non-sustaining expenditures is a helpful indicator of the aim of capital expenditures and this distinction is an enter into the calculation of attributable all-in sustaining prices per ounce and attributable all-in prices per ounce. The categorization of sustaining capital expenditures and non-sustaining capital expenditures is in keeping with the definitions beneath the WGC all-in value customary. Sustaining capital expenditures and non-sustaining capital expenditures will not be outlined beneath IFRS, nonetheless, the sum of those two measures whole to additions to property, plant and tools as disclosed beneath IFRS on the interim condensed consolidated statements of money flows.

Additions to property, plant and tools per the assertion of money movement consists of 100% of capital expenditures for Manh Choh. Attributable capital expenditures consists of Kinross’ 70% share of capital expenditures for Manh Choh. Administration believes this to be a helpful indicator of Kinross’ money assets utilized for capital expenditures.

The next desk gives a reconciliation of the classification of capital expenditures for the intervals introduced:

| (unaudited, expressed in thousands and thousands of U.S. {dollars}) | ||||||||||||||||||||||

| Three months ended September 30, 2024 | Tasiast (Mauritania) |

Paracatu (Brazil) |

La Coipa (Chile) |

Fort Knox (ok) (USA) |

Spherical Mountain (USA) | Bald Mountain (USA) | Whole USA |

Different | Whole | |||||||||||||

| Sustaining capital expenditures | $ | 13.5 | $ | 41.2 | $ | 21.3 | $ | 56.6 | $ | 5.2 | $ | 5.0 | $ | 66.8 | $ | 0.2 | $ | 143.0 | ||||

| Non-sustaining capital expenditures | 70.3 | – | 3.6 | 13.8 | 30.7 | 1.1 | 45.6 | 16.2 | 135.7 | |||||||||||||

| Additions to property, plant and tools – per money movement | $ | 83.8 | $ | 41.2 | $ | 24.9 | $ | 70.4 | $ | 35.9 | $ | 6.1 | $ | 112.4 | $ | 16.4 | $ | 278.7 | ||||

| Much less: Non-controlling curiosity (b) | $ | – | $ | – | $ | – | $ | (3.2 | ) | $ | – | $ | – | $ | (3.2 | ) | $ | – | $ | (3.2 | ) | |

| Attributable (a) capital expenditures | $ | 83.8 | $ | 41.2 | $ | 24.9 | $ | 67.2 | $ | 35.9 | $ | 6.1 | $ | 109.2 | $ | 16.4 | $ | 275.5 | ||||

| Three months ended September 30, 2023 | ||||||||||||||||||||||

| Sustaining capital expenditures | $ | 12.2 | $ | 58.4 | $ | 7.5 | $ | 52.1 | $ | 7.7 | $ | 20.6 | $ | 80.4 | $ | 0.6 | $ | 159.1 | ||||

| Non-sustaining capital expenditures | 65.1 | – | 7.7 | 43.9 | 0.1 | 4.3 | 48.3 | 3.7 | 124.8 | |||||||||||||

| Additions to property, plant and tools – per money movement | $ | 77.3 | $ | 58.4 | $ | 15.2 | $ | 96.0 | $ | 7.8 | $ | 24.9 | $ | 128.7 | $ | 4.3 | $ | 283.9 | ||||

| Much less: Non-controlling curiosity (b) | $ | – | $ | – | $ | – | $ | (11.5 | ) | $ | – | $ | – | $ | (11.5 | ) | $ | – | $ | (11.5 | ) | |

| Attributable (a) capital expenditures | $ | 77.3 | $ | 58.4 | $ | 15.2 | $ | 84.5 | $ | 7.8 | $ | 24.9 | $ | 117.2 | $ | 4.3 | $ | 272.4 | ||||

| (unaudited, expressed in thousands and thousands of U.S. {dollars}) | ||||||||||||||||||||||

| 9 months ended September 30, 2024 | Tasiast (Mauritania) |

Paracatu (Brazil) |

La Coipa (Chile) |

Fort Knox (ok) (USA) |

Spherical Mountain (USA) | Bald Mountain (USA) | Whole USA |

Different | Whole | |||||||||||||

| Sustaining capital expenditures | $ | 30.6 | $ | 105.4 | $ | 39.2 | $ | 141.9 | $ | 11.0 | $ | 41.8 | $ | 194.7 | $ | (1.0 | ) | $ | 368.9 | |||

| Non-sustaining capital expenditures | 207.9 | – | 3.6 | 96.3 | 81.4 | 1.3 | 179.0 | 35.4 | 425.9 | |||||||||||||

| Additions to property, plant and tools – per money movement | $ | 238.5 | $ | 105.4 | $ | 42.8 | $ | 238.2 | $ | 92.4 | $ | 43.1 | $ | 373.7 | $ | 34.4 | $ | 794.8 | ||||

| Much less: Non-controlling curiosity (b) | $ | – | $ | – | $ | – | $ | (22.7 | ) | $ | – | $ | – | $ | (22.7 | ) | $ | – | $ | (22.7 | ) | |

| Attributable (a) capital expenditures | $ | 238.5 | $ | 105.4 | $ | 42.8 | $ | 215.5 | $ | 92.4 | $ | 43.1 | $ | 351.0 | $ | 34.4 | $ | 772.1 | ||||

| 9 months ended September 30, 2023 | ||||||||||||||||||||||

| Sustaining capital expenditures | $ | 35.9 | $ | 125.9 | $ | 29.0 | $ | 142.8 | $ | 25.6 | $ | 43.2 | $ | 211.6 | $ | 1.8 | $ | 404.2 | ||||

| Non-sustaining capital expenditures | 187.9 | – | 34.9 | 111.3 | 0.1 | 38.3 | 149.7 | 10.3 | 382.8 | |||||||||||||

| Additions to property, plant and tools – per money movement | $ | 223.8 | $ | 125.9 | $ | 63.9 | $ | 254.1 | $ | 25.7 | $ | 81.5 | $ | 361.3 | $ | 12.1 | $ | 787.0 | ||||

| Much less: Non-controlling curiosity (b) | $ | – | $ | – | $ | – | $ | (29.7 | ) | $ | – | $ | – | $ | (29.7 | ) | $ | – | $ | (29.7 | ) | |

| Attributable (a) capital expenditures | $ | 223.8 | $ | 125.9 | $ | 63.9 | $ | 224.4 | $ | 25.7 | $ | 81.5 | $ | 331.6 | $ | 12.1 | $ | 757.3 | ||||

| See pages 20 and 21 for particulars of the footnotes referenced throughout the desk above. | ||||||||||||||||||||||

| (a) “Attributable” consists of Kinross’ share of Manh Choh (70%) money flows, prices, gross sales and capital expenditures.

(b) “Non-controlling curiosity” represents the non-controlling curiosity portion in Manh Choh (30%) and different subsidiaries for which the Firm’s curiosity is lower than 100% for money movement from working actions, prices, gross sales and capital expenditures, as acceptable. (c) “Manufacturing value of gross sales per equal ounce bought” is outlined as manufacturing value of gross sales divided by whole gold equal ounces bought. (d) “Silver income” represents the portion of steel gross sales realized from the manufacturing of the secondary or by-product steel (i.e. silver). Income from the sale of silver, which is produced as a by-product of the method used to supply gold, successfully reduces the price of gold manufacturing. (e) “Common and administrative” bills are as reported on the interim condensed consolidated statements of operations, excluding sure impacts which the Firm believes will not be reflective of the Firm’s underlying efficiency for the reporting interval. Common and administrative bills are thought-about sustaining prices as they’re required to be absorbed on a seamless foundation for the efficient operation and governance of the Firm. (f) “Different working expense – sustaining” is calculated as “Different working expense” as reported on the interim condensed consolidated statements of operations, much less the non-controlling curiosity portion in Manh Choh (30%) and different subsidiaries for which the Firm’s curiosity is lower than 100% and different working and reclamation and remediation bills associated to non-sustaining actions in addition to different gadgets not reflective of the underlying working efficiency of our enterprise. Different working bills are labeled as both sustaining or non-sustaining based mostly on the sort and placement of the expenditure incurred. Nearly all of different working bills which can be incurred at present operations are thought-about prices essential to maintain operations, and are subsequently, labeled as sustaining. Different working bills incurred at areas the place there isn’t any present operation or associated to different non-sustaining actions are labeled as non-sustaining. (g) “Reclamation and remediation – sustaining” is calculated as present interval accretion associated to reclamation and remediation obligations plus present interval amortization of the corresponding reclamation and remediation property, much less the non-controlling curiosity portion in Manh Choh (30%) and different subsidiaries for which the Firm’s curiosity is lower than 100%, and is meant to mirror the periodic value of reclamation and remediation for presently working mines. Reclamation and remediation prices for improvement initiatives or closed mines are excluded from this quantity and labeled as non-sustaining. (h) “Exploration and enterprise improvement – sustaining” is calculated as “Exploration and enterprise improvement” bills as reported on the interim condensed consolidated statements of operations, much less the non-controlling curiosity portion in Manh Choh (30%) and different subsidiaries for which the Firm’s curiosity is lower than 100% and non-sustaining exploration and enterprise improvement bills. Exploration bills are labeled as both sustaining or non-sustaining based mostly on a willpower of the sort and placement of the exploration expenditure. Exploration expenditures throughout the footprint of working mines are thought-about prices required to maintain present operations and are subsequently included in sustaining prices. Exploration expenditures centered on new ore our bodies close to present mines (i.e. brownfield), new exploration initiatives (i.e. greenfield) or for different generative exploration exercise not linked to present mining operations are labeled as non-sustaining. Enterprise improvement bills are labeled as both sustaining or non-sustaining based mostly on a willpower of the kind of expense and requirement for common or progress associated operations. (i) “Additions to property, plant and tools – sustaining” and non-sustaining are as introduced on pages 19 and 20 of this information launch and embody Kinross’ share of Manh Choh’s (70%) sustaining and non-sustaining capital expenditures. (j) “Lease funds – sustaining” represents the vast majority of lease funds as reported on the interim condensed consolidated statements of money flows and is made up of the principal and financing parts of such money funds, much less the non-controlling curiosity portion in Manh Choh (30%) and different subsidiaries for which the Firm’s curiosity is lower than 100%, and non-sustaining lease funds. Lease funds for improvement initiatives or closed mines are labeled as non-sustaining. (ok) The Fort Knox section consists of Fort Knox and Manh Choh for all intervals introduced. |

||||||||||||||||||||||

Appendix A

Drilling at Spherical Mountain Part X demonstrating robust grades and widths throughout the exploration goal and potential for extensions.

An infographic accompanying this announcement is obtainable at https://www.globenewswire.com/NewsRoom/AttachmentNg/f1da5154-7107-48ec-b89d-b5d15f749068

Appendix B

Curlew Basin lengthy part demonstrating optimistic exploration outcomes outdoors of the identified useful resource on the Stealth, EVP and Roadrunner zones. These intercepts exhibit larger gold grades and elevated vein widths relative to these within the present mine plan, reinforcing Curlew’s potential for continued useful resource progress.

An infographic accompanying this announcement is obtainable at https://www.globenewswire.com/NewsRoom/AttachmentNg/d06ba9b6-bbab-4644-8bba-25b05581976c

Cautionary assertion on forward-looking info