Supply: The School Investor

When evaluating 529 plans, it’s essential to each have a look at efficiency and charges.

Two researchers on the College of Kansas Faculty of Enterprise have recognized issues in how some states handle their 529 school financial savings plans. They counsel that these issues are brought on by conflicts of curiosity, insufficient oversight, and an absence of funding sophistication by the state sponsors.

In accordance with the School Financial savings Plan Community, a complete of $508 billion is invested in 16.8 million 529 school financial savings plans as of June 30, 2024.

The result’s that customers who use 529 plans in sure states might be paying extra charges (because of these conflicts of curiosity), which decrease their funding returns over time. If in a position to choose, customers ought to go for the bottom plan charges doable to maximise returns.

You will discover your state’s plan and see the charges in our 529 Plan Information By State.

Traits of 529 Plan Charges

Justin Balthrop and Gjergji Cici of the College of Kansas analyzed 5,339 distinctive funding choices throughout 86 state 529 school financial savings plans for his or her paper, Conflicting Incentives within the Administration of 529 Plans.

Two-thirds of the 529 plans are direct-sold and one-third are advisor-sold. Solely 10% of the plans are managed in-house, with the remainder outsourced to exterior program managers. A 3rd have revenue-sharing agreements with the underlying mutual funds.

About half of the full charges from 529 plans go to the state, this system managers, and varied intermediaries.

The executive asset-based charges for 529 plans are 5 instances larger than the same charges for managing a retirement plan.

The common 529 plan charges embrace the next:

- State Charges: 0.04%, however might be as excessive as 0.26%

- Program Supervisor Charges: 0.16%, however might be as excessive as 1.15%

- Distribution Charges: 0.23%, however might be as excessive as 1.10%

- Underlying Fund Charges: 0.38%, however might be as excessive as 1.29%

The general expense ratio – the sum of all asset-based charges – averages 0.81% with a normal deviation of 0.53%. The expense ratio might be as excessive as 2.49%.

On condition that the typical return on funding for a 529 plan is about 6% based mostly on historic efficiency information, some states and program managers are extracting a good portion of investor returns for their very own profit.

In some instances, households could be higher off saving in taxable accounts.

States With The Highest 529 Plan Charges

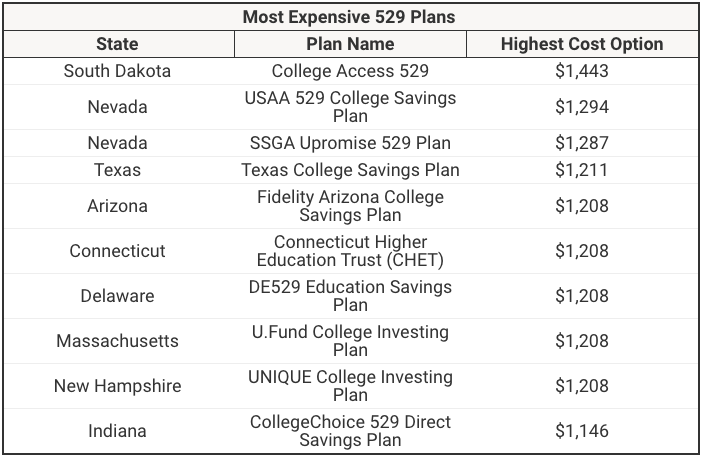

In accordance with the newest Saving For School 529 Plan Price Research, listed below are the states with the very best charges. This research appears on the 10-years prices of a $10,000 funding for direct-sold plans. It is necessary to notice that advisor-sold plans can have a lot larger charges.

Evaluating the most costly plan choice to the least costly possibility, South Dakota School Entry 529 prices over 10x the charges of the Lousiana START Financial savings Program.

The ten most costly 529 plans in america all cost virtually 3x the of charges of the ten least costly plans in america.

Listed below are the ten most costly 529 plans in america (bear in mind, every state can, and usually does, have a number of plan choices):

Evaluation of the most costly 529 plans by state. Supply: The School Investor

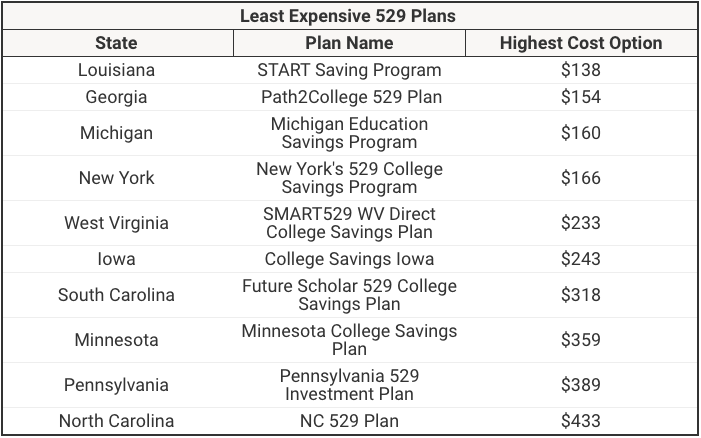

You’ll be able to evaluate the above states and plans with the choices beneath. We’re highlighting the HIGHEST value possibility within the state. Louisiana does provide a plan with $0 prices, which is a set revenue plan managed immediately by the state treasurer, however this plan is just open to in-state residents.

Evaluation of the least costly 529 plans by state. Supply: The School Investor

Tradeoff between State Income and Program High quality

Some states cost larger charges than different states, however this typically doesn’t yield an enchancment in program high quality. Actually, fairly the other.

The 529 plans in states that extract extra income from the 529 plans provide extra restricted funding choices that cost larger charges and supply inferior internet efficiency. The rise within the underlying fund charges is a few quarter of common mutual fund charges.

The upper-cost 529 plans provide fewer funding choices and are much less prone to provide low-cost index funds. These states additionally don’t present further or higher state revenue tax breaks.

The College of Kansas researchers discovered that funding choices from plans the place states extract probably the most income have a mean underlying fund expense ratio of 0.506%, whereas funding choices from states that extract the least income have a mean underlying expense ratio of 0.219%. Thus, when a state extracts extra income from the state’s 529 plan, the expense ratio is greater than twice as excessive (2.3x larger).

The College of Kansas researchers additionally used Sharpe Ratios calculated by Morningstar for all of the 529 plans, displaying that buyers in these higher-cost 529 plans expertise worse efficiency.

A Sharpe Ratio is a risk-adjusted return on funding. It’s the 529 plan’s return on funding minus the risk-free charge of return and divided by the usual deviation of the surplus return. A better Sharpe Ratio is healthier.

The 529 plans from states that extract extra income from the 529 plans have a decrease Sharpe Ratio than 529 plans from states that extract much less income, an indication that the funding plan efficiency, internet of charges, is inferior. The Sharpe Ratios within the 529 plans within the excessive revenue-extraction states are 20% decrease than the Sharpe Ratios within the states that extract the least income from the 529 plans.

Associated: Finest 529 Plans Based mostly On Efficiency

Conflicts of Curiosity

Since 529 plans generate income for the states and program managers, there’s potential for conflicts of curiosity.

Incentives for the state will not be essentially aligned with the most effective pursuits of plan individuals.

States get larger charges in change for offering program managers with extra flexibility to extract extra income, immediately and not directly, from plan individuals.

529 plans usually embrace funding choices from this system supervisor’s personal mutual funds and from funding corporations with which this system supervisor has revenue-sharing agreements.

529 plans with revenue-share agreements have underlying fund charges and complete expense ratios which are 0.08% and 0.18% larger than different 529 plans.

Some examples the report highlighted have been plans utilizing extra charges to fund different state initiatives. Or there being a dis-incentive to barter higher charges for buyers since states benefit from the extra revenues. In probably the most egregious type, 529 plan charges could also be used to fund promoting campaigns that some critics have known as political campaigning, fairly than investor training.

Lax Oversight

There’s little or no efficient oversight over the administration of 529 plans.

529 plans are exempt from the Funding Firm Act of 1940 and Securities Act of 1933. They aren’t required to register with the Securities and Trade Fee (SEC), so the SEC is just not a supply of investor safety. SEC guidelines regarding funding disclosure don’t apply to the 529 plans.

529 plans will not be topic to a fiduciary commonplace. Nevertheless, SEC rules do require funding advisors, akin to people who advocate advisor-sold 529 plans, to reveal conflicts of curiosity and take into account prices when recommending merchandise. The SEC’s Regulation Finest Curiosity (Reg BI) is just not fairly a fiduciary commonplace, only a suitability commonplace. It doesn’t apply to the 529 plans themselves, simply the funding advisors.

The states present some oversight by appointing advisory boards. Nevertheless, the politically-appointed advisory boards could lack the monetary sophistication wanted to align the 529 plan with the most effective pursuits of buyers.

Program managers usually present extra charge income to the states which have weaker oversight.

Insufficient disclosures make it more durable for buyers to make knowledgeable selections. There aren’t any uniform disclosure practices which are standardized throughout all 529 plans.

States that cost larger charges, which impacts the online return on funding, don’t present higher advantages for buyers.

The states present some oversight by appointing advisory boards. Nevertheless, the politically-appointed advisory boards usually lack the monetary sophistication wanted to align the 529 plan with the most effective pursuits of buyers.

States that cost larger charges, which impacts the online , don’t present higher advantages for buyers.

Program managers usually present extra charge income to the states which have weaker oversight.

Insufficient disclosures make it more durable for buyers to make knowledgeable selections. There aren’t any uniform disclosure practices which are standardized throughout all 529 plans.

Evaluating 529 Plans: Suggestions for Buyers

Minimizing prices is the important thing to maximizing internet returns.

Increased charges will not be related to a greater internet efficiency after subtracting the charges from funding returns. The funding choices don’t essentially present higher returns on funding. Even once they do, the elevated returns will not be sufficient to compensate for the upper charges.

So, buyers ought to select the state 529 plans with the bottom charges.

There’s usually a tradeoff between low charges in an out-of-state 529 plan and state revenue tax breaks for contributions to the state’s personal 529 plan. There’s an inflection level between selecting low charges and state revenue tax breaks when the kid enters highschool. Hold the next in thoughts, if selecting a 529 plan sooner or later:

- When the kid is younger, the households ought to give attention to 529 plans which have decrease charges.

- When the kid enters highschool, new contributions needs to be directed to that state’s 529 plan if the state gives a state revenue tax break on contributions to the state’s 529 plan.

Low charges apply to your complete 529 plan stability, whereas the state revenue tax break applies solely to every 12 months’s new contributions.

Morningstar.com and Savingforcollege.com present scores of 529 plans that take into account the online return on funding after subtracting the charges. Savingforcollege.com additionally publishes a that evaluates the affect of the vary of charges prices by every direct-sold 529 plan’s funding choices.

For a greater understanding of contributing to a 529 plan in your state and what charges are concerned, take a look at our full 529 information.