Results not more likely to be felt for a while

Article content material

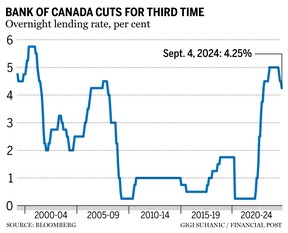

On Wednesday, the Financial institution of Canada minimize its benchmark rate of interest by 25 foundation factors for the third consecutive time, bringing it right down to 4.25 per cent. Economists are predicting additional rate of interest cuts by the central financial institution for the rest of the yr and into 2025. Right here’s what consultants need to say in regards to the influence of the cuts on Canada’s actual property markets:

‘It’ll take a number of extra decreases’: Charges.ca

Commercial 2

Article content material

Whereas it’s excellent news that the Financial institution of Canada is continuous to decrease its in a single day price, the impact on the housing market is not going to probably be seen for a while, mentioned Victor Tran, Charges.ca’s mortgage and actual property skilled.

For each 25-basis level drop, a home-owner with a variable-rate mortgage can count on a discount of roughly $15 in month-to-month funds per $100,000 of mortgage, in line with insurance coverage comparability web site Charges.ca.

Tran mentioned fixed-rate mortgage holders is not going to see the results of any mortgage price decreases till they renew.

He famous that housing market exercise in main city centres like Toronto and Vancouver has not picked up almost as a lot as anticipated in current months. Regardless of the earlier price decreases, mortgage charges stay fairly excessive, he added.

Even a drop of a full share level from present mortgage charges wouldn’t end in a big improve in shopping for energy given persistently excessive house costs, he defined.

“Mortgage charges haven’t come down almost quick sufficient to stimulate a lot exercise within the housing market. It’s simply not inexpensive for folks,” Tran mentioned. “It’ll take a big lower in mortgage charges earlier than we see a return of housing market exercise.”

Article content material

Commercial 3

Article content material

Contemplating the nationwide common value of a house is roughly $700,000, a single share level lower would probably not make a big distinction in a possible home-owner’s skill to buy the property, he mentioned.

In line with Charges.ca’s mortgage quoter, the bottom insured five-year fastened price mortgage sits at 4.34 per cent, and the bottom insured five-year variable price mortgage sits at 5.4 per cent.

‘Not going to resuscitate the housing market’: Nerdwallet Canada

This newest price minimize from the Financial institution of Canada will make issues a bit simpler for mortgage customers dedicated to variable charges, however it’s not going to resuscitate the housing market, says Clay Jarvis, Nerdwallet Canada’s mortgage and actual property skilled.

There have been considerably decrease fastened charges accessible to consumers all yr. In the event that they’re not succeeding, it’s most likely on account of different components, equivalent to excessive house costs, elevated debt hundreds, diminished financial savings and worries in regards to the financial system, he mentioned. A slight dip in variable charges doesn’t decrease any of those obstacles to the market, he famous.

Commercial 4

Article content material

‘The important thing query is whether or not to purchase now or wait’: Royal LePage

With this current price minimize, the important thing query for first-time homebuyers is whether or not to purchase now or wait, mentioned Phil Soper, chief govt at Royal LePage Actual Property Companies Ltd.

The Financial institution of Canada continues its delicate balancing act, progressively easing the financial drag of excessive rates of interest because the financial system cools. With inflation now at its lowest level in three years, coverage makers are shifting their focus to jobs and housing, famous Soper.

On one hand, house values have largely plateaued this yr and affordability has improved on account of decrease borrowing prices, he mentioned. Nevertheless, as soon as the backlog of sidelined consumers is launched into the market, pent-up demand will drive costs increased.

“This fall, we are able to count on extra cautious Canadians to make the leap, whereas these prepared to tackle the danger would possibly maintain out for additional price cuts,” Soper mentioned.

Housing stays challenged: Macquarie

Regardless of price cuts, housing in Canada stays challenged with current house gross sales subdued and renovation spending slowing, famous David Doyle, head of economics at Macquarie Group Ltd.

Commercial 5

Article content material

Doyle mentioned the share of customers anticipating actual property costs to rise has slid in current weeks and rests beneath ranges seen when the speed hike cycle commenced.

This acts as embedded tightening that’s set to worsen in 2025 and 2026 and shall be a drag on housing resales, renovations, and discretionary client spending, he mentioned.

He added that the Financial institution of Canada probably must scale back charges to a decrease degree than the USA Federal Reserve over the approaching 12 months.

Anticipate additional price reduction: Financial institution of Montreal

Canadian mortgage holders ought to anticipate additional price reduction after borrowing prices peaked late final yr, mentioned Financial institution of Montreal senior economist Sal Guatieri.

Douglas Porter, chief economist at BMO, mentioned the Financial institution of Canada has hinted at extra aggressive price cuts if inflation slows quicker than anticipated — though they haven’t been shocked by current traits.

Really useful from Editorial

Porter mentioned the financial institution is anticipated to proceed grinding down charges in coming conferences. “Whereas we anticipate a collection of 25-basis level steps into early subsequent yr, we definitely is not going to rule out a potential 50-basis level step in some unspecified time in the future,” he added.

• Electronic mail: dpaglinawan@postmedia.com

Bookmark our web site and assist our journalism: Don’t miss the enterprise information that you must know — add financialpost.com to your bookmarks and join our newsletters right here.

Need to know extra in regards to the mortgage market? Learn Robert McLister’s weekly column within the Monetary Submit for the most recent traits and particulars on financing alternatives you received’t wish to miss.

Article content material